Duke Energy Corp: A Beacon of Stability in the Utilities Sector?

In the ever-fluctuating world of utilities, Duke Energy Corp stands out as a paragon of stability and investor confidence. As a major player in the electric utilities sector, the company has recently made headlines with its strategic financial decisions, particularly concerning dividend payments. But is this stability a sign of strength or a mask for underlying challenges?

Dividend Decisions: A Double-Edged Sword

Duke Energy Corp has announced the maintenance of its quarterly dividend at a consistent level, a move that ostensibly signals confidence in its financial health. This decision is likely to be welcomed by investors seeking steady returns, as it underscores the company’s commitment to providing reliable shareholder returns. However, one must question whether this consistency is a result of robust financial performance or a strategic maneuver to placate investors amidst potential underlying issues.

Stock Performance: A Closer Look

The company’s stock price has shown a moderate increase over the past year, recently closing above its 52-week high. This uptick in stock performance might suggest a positive market sentiment towards Duke Energy’s strategic decisions. However, it’s crucial to scrutinize whether this rise is driven by genuine growth prospects or merely investor optimism fueled by dividend stability.

Market Position: A Critical Examination

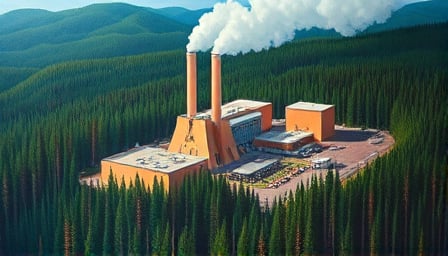

With a market capitalization of $94.21 billion and a price-to-earnings ratio of 21.33, Duke Energy Corp is undeniably a heavyweight in the utilities sector. The company’s integrated network of energy assets across the Americas positions it as a key player in both natural gas and electric supply. Yet, one must ponder if this market position is sustainable in the long term, especially in an industry facing increasing pressure from renewable energy sources and regulatory changes.

Conclusion: Stability or Stagnation?

Duke Energy Corp’s recent actions, particularly regarding dividend payments and stock performance, paint a picture of a company focused on maintaining investor confidence. However, beneath this veneer of stability, critical questions remain. Is Duke Energy truly poised for long-term growth, or is it merely clinging to short-term stability? As the utilities sector evolves, only time will tell if Duke Energy can adapt and thrive or if it will become a relic of a bygone era. Investors and analysts alike should remain vigilant, questioning the true drivers behind Duke Energy’s apparent stability.