Duxton Farms Ltd: A Snapshot of Current Performance and Operations

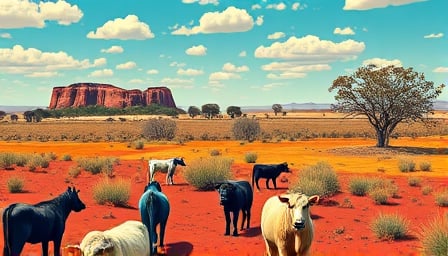

Duxton Farms Ltd, a prominent player in the Consumer Staples sector, specifically within the Food Products industry, has been making headlines with its recent financial performance and strategic operations. As an investment company based in Australia, Duxton Farms Ltd focuses on the acquisition and aggregation of land properties, aiming to develop a diverse range of commodities. The company also offers opportunities for direct participation in the grain industries and other farm product sectors, positioning itself as a key player in the agricultural investment landscape.

Financial Overview

As of September 1, 2025, Duxton Farms Ltd’s close price stood at 0.985 AUD, reflecting a significant fluctuation over the past year. The company’s stock has experienced a 52-week high of 1.575 AUD on September 4, 2024, and a 52-week low of 0.97 AUD on August 27, 2025. This volatility highlights the dynamic nature of the agricultural investment market and the challenges faced by companies like Duxton Farms Ltd in maintaining stable growth.

The company’s market capitalization is currently valued at 45,870,000 AUD. However, the Price Earnings (P/E) ratio is reported at -3.09, indicating that the company is not currently generating profits. This negative P/E ratio is a critical point of consideration for investors, as it reflects the company’s ongoing investment phase and the potential for future profitability.

Strategic Focus and Opportunities

Duxton Farms Ltd’s strategic focus on land acquisition and development is central to its business model. By aggregating land properties, the company aims to create value through the development of various commodities, leveraging Australia’s rich agricultural resources. This approach not only diversifies the company’s portfolio but also enhances its resilience against market fluctuations.

In addition to land development, Duxton Farms Ltd provides unique opportunities for direct participation in the grain industries and other farm product sectors. This direct involvement allows investors to engage with the agricultural sector more intimately, potentially leading to higher returns as the company’s projects mature.

Market Presence and Accessibility

Listed on the ASX All Markets stock exchange, Duxton Farms Ltd is accessible to a broad range of investors, both domestic and international. The company’s official website, www.duxtonfarms.com , serves as a resource for potential investors and stakeholders, offering detailed information about its operations, investment opportunities, and strategic initiatives.

Conclusion

Duxton Farms Ltd continues to navigate the complexities of the agricultural investment market with a clear focus on land acquisition and commodity development. Despite the current lack of profitability, as indicated by its negative P/E ratio, the company’s strategic initiatives and market positioning suggest potential for future growth. Investors and stakeholders will be closely monitoring the company’s progress as it seeks to capitalize on Australia’s agricultural potential and deliver value to its shareholders.