E.ON SE Reports Strong H1 Performance and Reaffirms FY Outlook

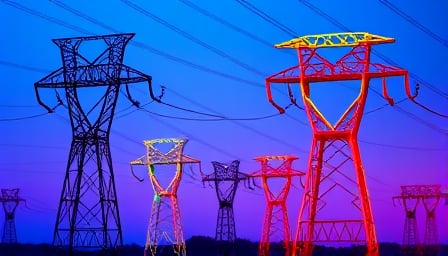

E.ON SE, one of Europe’s largest operators of energy networks and infrastructure, has reported a robust performance for the first half of 2025. The company, which serves approximately 51 million customers, announced an increase in revenue and adjusted EBITDA compared to the same period last year. Despite a decline in net profit during this period, the company’s strategic investments in energy network expansion have been a significant driver of growth.

According to a report from Avanza.se, E.ON’s revenue rose by 5.1% to €41.554 billion. The company’s adjusted EBITDA also saw an increase, underscoring its operational efficiency and strategic focus on expanding its energy infrastructure. This growth is attributed to the company’s ongoing investments in network expansion, which have been a cornerstone of its strategy.

In a separate report by Finanznachrichten.de, it was highlighted that E.ON’s investments in network expansion surged by 11% year-over-year, reaching €3.2 billion in the first half of 2025. This substantial investment underscores E.ON’s commitment to enhancing its energy infrastructure, which is crucial for supporting the transition to renewable energy sources and meeting the growing demand for sustainable energy solutions.

Seeking Alpha reported that E.ON SE has reaffirmed its full-year outlook, indicating confidence in its strategic direction and financial health. This reaffirmation comes amidst a challenging economic environment, where energy companies are navigating fluctuating energy prices and regulatory changes.

On the stock market front, E.ON’s shares experienced minimal movement, closing at €15.88 on August 11, 2025, as reported by Ariva.de. This stability reflects investor confidence in the company’s long-term growth prospects, despite short-term market fluctuations.

Overall, E.ON SE’s strong performance in the first half of 2025, driven by strategic investments in energy network expansion and a reaffirmed full-year outlook, positions the company well for continued growth in the utilities sector. With a market capitalization of €42.14 billion and a price-to-earnings ratio of 9.205, E.ON remains a key player in Europe’s energy landscape.