Elekta AB Financial Update: Mixed Signals Amidst Strong Earnings Report

Elekta AB, a leading healthcare equipment and supply company based in Stockholm, Sweden, recently released its Q4 2025 earnings report, which has elicited mixed reactions from the market and analysts. The company, known for its equipment and software for cancer and brain disorder treatments, reported a stronger-than-expected earnings result, yet faced challenges in its order intake.

Earnings Call and Market Reaction

On May 28, 2025, Elekta held its Q4 earnings call, where it reported a better-than-anticipated earnings result. Despite this positive outcome, the company’s order intake was weaker than expected, raising concerns among investors and analysts. Citi, in a report commentary, highlighted the weak order intake as a significant concern, questioning how Elekta might meet consensus expectations moving forward.

Despite these concerns, the market reacted positively to the earnings report. On the same day, Elekta’s stock experienced a notable increase, with the company’s shares rising by at least 5% at the opening of the Stockholm Stock Exchange. This uptick was attributed to the market’s focus on the improved gross and operating margins reported in the latest quarter.

Challenges and Strategic Moves

Elekta’s financial performance in the United States remains a point of concern, with the company expecting the weak order and revenue trends to persist into the early part of the 2025/2026 fiscal year. This outlook was shared by Elekta’s CFO, Tobias Hägglöv, during the earnings call. Additionally, the company is closely monitoring developments related to tariffs in the U.S., with interim CEO Jonas Bolander stating that Elekta is actively managing the situation.

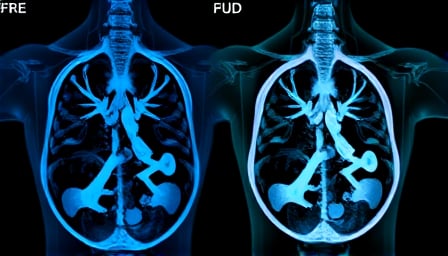

In a strategic move, Elekta announced its intention to resubmit an application to the U.S. Food and Drug Administration (FDA) for its CT-guided treatment system, Evo. This decision was disclosed during the earnings call and represents a significant step in Elekta’s efforts to expand its product offerings in the U.S. market.

Leadership and Recruitment

On the leadership front, Elekta is progressing with its external recruitment process for a new CEO, as stated by interim CEO Jonas Bolander. This development indicates the company’s proactive approach to leadership transition and strategic planning.

Financial Overview

As of May 25, 2025, Elekta’s stock closed at 50.1 SEK, with a 52-week high of 87.35 SEK and a low of 44.5 SEK. The company’s market capitalization stands at 185.6 billion SEK, with a price-to-earnings ratio of 18.56. These figures reflect the company’s strong position in the healthcare equipment and supplies sector, despite the challenges it faces.

In summary, Elekta AB’s Q4 2025 earnings report presents a mixed picture, with strong earnings overshadowed by concerns over order intake and the U.S. market’s performance. However, the company’s strategic initiatives, including the resubmission of the Evo system to the FDA and the ongoing CEO recruitment process, signal its commitment to overcoming these challenges and capitalizing on growth opportunities.