Eoptolink Technology Inc Ltd: A Surge in Market Confidence

In a recent development that has caught the attention of investors and market analysts alike, Eoptolink Technology Inc Ltd, a prominent player in the optical transceiver manufacturing sector, has seen a significant boost in its market valuation. This surge comes on the heels of a positive revision by Citi, which raised the company’s price target to RMB198, citing strong earnings as the primary reason. This move underscores the company’s robust performance and its pivotal role in the Information Technology sector, particularly within the electronic equipment, instruments, and components industry.

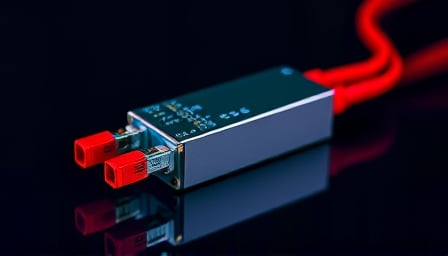

A Glimpse into Eoptolink’s Operations

Eoptolink Technology Inc Ltd, established in 2008 and headquartered in Chengdu, China, specializes in the production and sale of optical transceivers. These products find applications across a broad spectrum of ICT domains, including data centers, telecom networks, security monitoring, smart grids, and more. The company has carved a niche for itself by distributing its products through a network of telecom equipment distributors, dealers, system integrators, VARs, and manufacturing accounts. Furthermore, Eoptolink has expanded its footprint globally, exporting its products to approximately 60 countries and regions worldwide. The company’s presence on the Shenzhen Stock Exchange and its listing under the currency CNY further solidify its standing in the global market.

Market Dynamics and Eoptolink’s Position

The broader market dynamics have also played a crucial role in shaping the investment landscape for companies like Eoptolink. Recent reports indicate a strong performance across the A-share market, with the Shenzhen Stock Exchange witnessing a collective rise in its major indices. This bullish trend is particularly pronounced in the technology sector, where companies are experiencing a surge in investor interest. The market’s strong performance, coupled with a significant increase in trading volume, highlights the growing confidence among investors in the technology sector’s potential for growth.

Eoptolink’s Financial Health

As of July 15, 2025, Eoptolink’s close price stood at 169.8 CNY, with a 52-week high of 179.28 CNY and a low of 46.8857 CNY. The company boasts a market capitalization of 132,213,767,816 CNY, reflecting its substantial presence in the market. With a price-earnings ratio of 32.2985, Eoptolink’s financial metrics indicate a healthy balance between its market valuation and earnings, further attracting investor interest.

Looking Ahead

The recent price target adjustment by Citi, coupled with the company’s strong earnings and the favorable market conditions, paints a promising picture for Eoptolink Technology Inc Ltd. As the company continues to expand its global reach and strengthen its product offerings, it is well-positioned to capitalize on the growing demand for optical transceivers in various ICT applications. Investors and market watchers will undoubtedly keep a close eye on Eoptolink’s performance in the coming months, as it navigates the opportunities and challenges in the dynamic Information Technology sector.