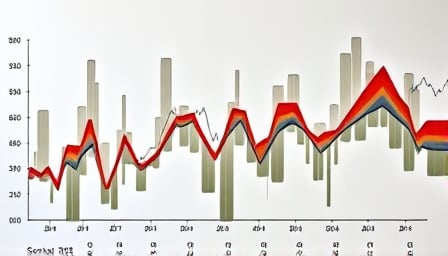

In the ever-evolving landscape of cryptocurrency, Equalizer DEX has emerged as a noteworthy player, capturing the attention of traders and investors alike. As of June 30, 2025, the close price of Equalizer DEX stood at $0.0335021, a figure that reflects both the volatility and potential of this digital asset. This price point is particularly significant when viewed against the backdrop of its 52-week performance, which has seen dramatic fluctuations.

A Rollercoaster Ride: The 52-Week Performance

The journey of Equalizer DEX over the past year has been nothing short of a rollercoaster. At its peak on October 16, 2024, the asset reached an impressive high of $19.5075. This peak was a testament to the growing interest and speculative investment in decentralized exchanges (DEXs), which promise greater autonomy and security for users. However, the path from peak to trough has been steep. By June 22, 2025, Equalizer DEX had plummeted to a 52-week low of $0.0285584, underscoring the inherent risks and volatility associated with cryptocurrency investments.

Understanding the Volatility

The dramatic swings in Equalizer DEX’s value highlight the volatile nature of the cryptocurrency market. Several factors contribute to this volatility, including regulatory news, technological advancements, market sentiment, and broader economic indicators. For Equalizer DEX, its position as a decentralized exchange adds layers of complexity and opportunity. DEXs operate without a central authority, allowing users to trade directly with one another. This model offers advantages in terms of privacy and reduced reliance on traditional financial systems, but it also introduces challenges, particularly in terms of liquidity and user experience.

The Potential of Decentralized Exchanges

Despite the volatility, the potential of decentralized exchanges like Equalizer DEX remains significant. They represent a shift towards a more democratized financial system, where users have greater control over their assets and transactions. For Equalizer DEX, the challenge lies in balancing innovation with user accessibility, ensuring that the platform remains competitive and appealing to a broad user base.

Looking Ahead

As we move forward, the trajectory of Equalizer DEX will likely continue to be influenced by both internal developments and external market forces. The cryptocurrency community will be watching closely to see how Equalizer DEX navigates the challenges of liquidity, user experience, and regulatory compliance. For investors and traders, the story of Equalizer DEX serves as a reminder of the dynamic and unpredictable nature of the cryptocurrency market.

In conclusion, Equalizer DEX’s journey through 2024 and into 2025 encapsulates the highs and lows of the cryptocurrency world. Its story is a microcosm of the broader trends and challenges facing decentralized exchanges today. As the market continues to evolve, Equalizer DEX will undoubtedly play a role in shaping the future of decentralized finance.