Forex Market Update: Euro/Indian Rupee Analysis

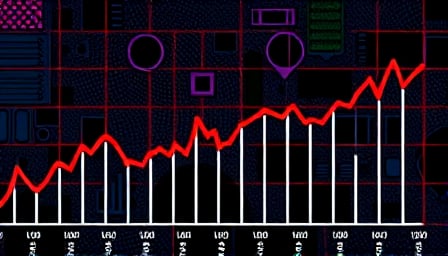

The Euro/Indian Rupee (EUR/INR) forex pair has been a focal point for traders and analysts, reflecting significant movements in recent months. As of August 3, 2025, the close price for the EUR/INR stood at 98.814, indicating a notable position within its 52-week range.

Recent Performance and Trends

The EUR/INR pair has experienced fluctuations, with a 52-week high of 101.754 recorded on July 23, 2025. This peak represents a substantial appreciation of the Euro against the Indian Rupee. Conversely, the pair reached a 52-week low of 86.9247 on November 24, 2024, highlighting the volatility and dynamic nature of the forex market.

Market Dynamics

The primary exchange for the EUR/INR is the IDEAL PRO, which plays a crucial role in facilitating trades and providing liquidity. The recent close price of 98.814 suggests a moderate recovery from the lows observed earlier in the year, reflecting broader economic factors and market sentiment.

Implications for Traders

Traders monitoring the EUR/INR pair should consider the historical volatility and the potential for further fluctuations. The recent trends indicate a cautious optimism, with the Euro gaining strength against the Indian Rupee. However, the market remains sensitive to geopolitical and economic developments that could influence future movements.

Conclusion

The EUR/INR forex pair continues to be an area of interest for investors and analysts alike. With its recent performance and historical context, the pair offers insights into the broader economic interactions between the Eurozone and India. As the market evolves, stakeholders will closely watch for any shifts that could impact the currency dynamics.