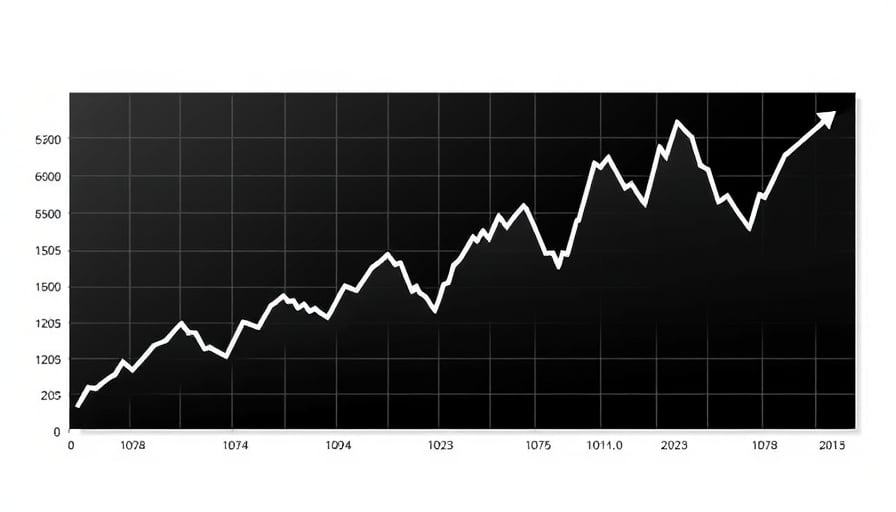

Exchange Rate Context

The Euro‑to‑British Pound pair remained close to its 52‑week low on 6 November 2025, trading at 0.87882 against a high of 0.88286 on 4 November. The pair’s lowest level over the past year was 0.8035 on 24 December 2024.

Global Market Influences

Recent developments in the technology and financial sectors have shaped broader market sentiment:

Artificial‑Intelligence‑driven investment concerns: U.S. equity markets experienced modest losses on 7 November amid worries that the rapid rise of AI‑related valuations could trigger a bubble. The Dow Jones and S&P 500 indices fell 0.8 % and 1.1 %, respectively, at market close, reflecting sustained caution around high‑tech stocks.

AI infrastructure investment overseas: In Kazakhstan, Freedom Holding Corp. announced a $2 billion project to build a sovereign AI hub powered by NVIDIA. The announcement underscored continued global investment in AI infrastructure, which can influence currency flows and risk appetite.

Cryptocurrency regulatory expansion: WhiteBIT’s expansion into Argentina and Brazil, including obtaining a Virtual Asset Service Provider registration in Argentina, highlights the growing regulatory acceptance of crypto assets in emerging markets. While this does not directly impact the Euro/Pound pair, it signals a broader shift in asset allocation that can affect foreign exchange volatility.

Potential Impact on the Euro‑Pound Pair

Risk‑off sentiment: Persistent concerns over high‑tech valuations and the possibility of a broader market correction may reinforce risk‑off sentiment, leading investors to seek safe‑haven currencies such as the British Pound.

Liquidity flows: Increased investment in AI infrastructure, particularly in emerging economies, could attract capital outflows from euro‑area markets, supporting the Pound relative to the Euro.

Regulatory developments: The expansion of crypto services in Latin America may prompt reassessment of digital asset exposure within euro‑area portfolios, potentially affecting currency demand dynamics.

Outlook

Given the current proximity of the Euro/Pound pair to its 52‑week low and the backdrop of technology‑related market caution, the pair remains susceptible to further downward pressure. Monitoring developments in AI investment, U.S. equity market sentiment, and crypto regulatory changes will be essential for assessing future directional moves in the Euro/Pound exchange rate.