In the ever-evolving landscape of utility services, Exelon Corporation stands as a pivotal player, particularly within the electric utilities sector. As a holding company, Exelon is instrumental in distributing electricity to customers in Illinois and Pennsylvania, while also providing gas services in the Philadelphia area. This dual role underscores its significance in ensuring energy reliability and affordability for millions of consumers.

As of the latest update, Exelon has not announced any new developments. However, the company’s recent activities have been noteworthy, particularly its approval of a Treasury tax notice on 19 February 2026. This strategic move is designed to bolster grid investment and enhance affordability, reflecting Exelon’s commitment to sustainable energy infrastructure and consumer welfare.

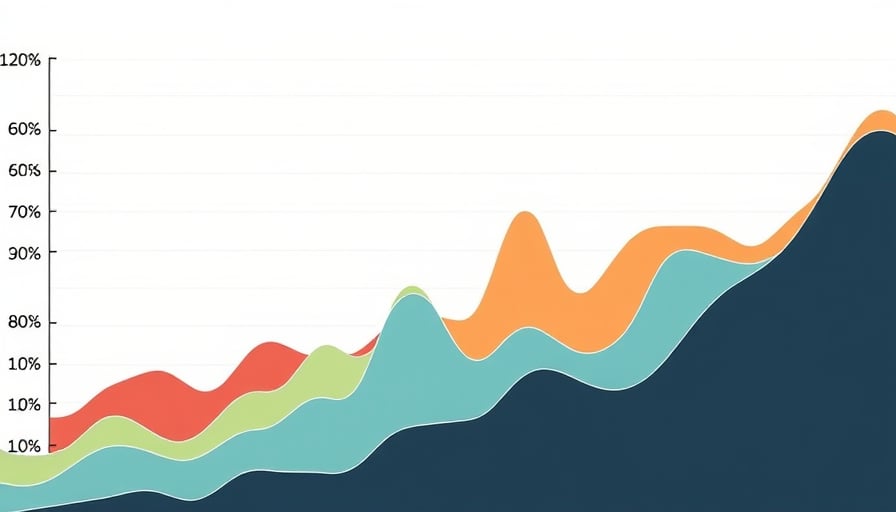

Financially, Exelon’s performance has been robust, with the company closing at $47.79 on 19 February 2026. Over the past year, the stock has experienced fluctuations, reaching a 52-week high of $49.11 on 16 February 2026, and a low of $41.71 on 13 May 2025. These figures illustrate the dynamic nature of the market and Exelon’s resilience in navigating these changes.

Valuation metrics provide further insight into Exelon’s financial health. With a price-to-earnings ratio of 17.51, the company is moderately valued relative to its earnings, suggesting a balanced approach to growth and profitability. Additionally, a price-to-book ratio of 1.72 indicates that Exelon’s market value is slightly above its book value, reflecting investor confidence in its assets and future prospects.

Exelon’s market capitalization stands at an impressive $488.8 billion, underscoring its substantial presence in the utilities sector. This valuation not only highlights Exelon’s financial strength but also its strategic importance in the broader energy landscape.

In summary, Exelon Corporation continues to play a crucial role in the utility services industry, with a focus on enhancing grid investment and affordability. Its financial metrics and strategic initiatives position it well for future growth, ensuring it remains a key player in the energy sector. As the company navigates the complexities of the market, its commitment to sustainability and consumer service remains at the forefront of its operations.