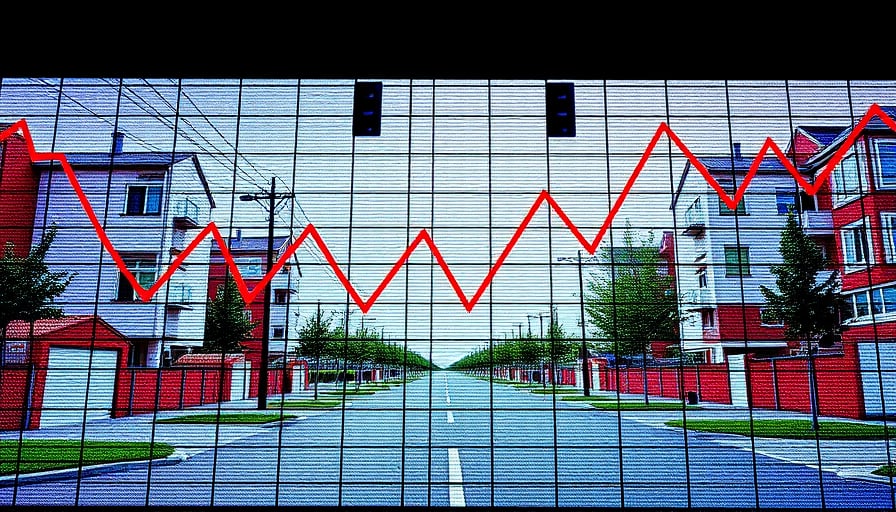

In the ever-evolving landscape of cryptocurrency, FEAR has emerged as a focal point of discussion among investors and analysts alike. As of January 27, 2026, the asset’s close price stood at $0.000658671, reflecting a significant fluctuation from its 52-week high of $0.0743067 on February 6, 2025, to a low of $0.000389984 on January 25, 2026. This volatility underscores the inherent risks and opportunities within the crypto market, particularly for assets like FEAR that exhibit such dramatic price movements.

The market capitalization of FEAR, currently valued at $11,668.626 USD, positions it as a relatively small player in the vast cryptocurrency ecosystem. This modest market cap, juxtaposed with its historical price volatility, suggests a high-risk, high-reward scenario for investors. The asset’s recent performance, characterized by a sharp decline to its 52-week low, has undoubtedly instilled a sense of caution among stakeholders. However, it also presents a potential entry point for those willing to navigate the uncertainties of the crypto market.

The dramatic price swings of FEAR can be attributed to several factors, including market sentiment, regulatory developments, and broader economic indicators. The cryptocurrency market is notoriously sensitive to news and events, with investor sentiment often driving price movements. For FEAR, the recent downturn may reflect broader market trends or specific challenges facing the asset, such as technological issues, governance disputes, or competitive pressures.

Despite these challenges, FEAR’s journey from its 52-week high to its current valuation highlights the dynamic nature of the cryptocurrency market. Investors and analysts closely monitor such assets for signs of recovery or further decline, with the potential for significant returns on investment. The asset’s volatility, while daunting, also offers opportunities for strategic investment, particularly for those with a deep understanding of the market’s intricacies.

Looking ahead, the future of FEAR in the cryptocurrency landscape remains uncertain. The asset’s ability to recover from its recent lows and capitalize on potential market upswings will depend on a variety of factors, including technological advancements, regulatory clarity, and shifts in investor sentiment. As the crypto market continues to mature, assets like FEAR will play a crucial role in shaping the industry’s trajectory, offering insights into the challenges and opportunities that lie ahead.

In conclusion, FEAR’s recent performance serves as a reminder of the volatile nature of the cryptocurrency market. While the asset’s current valuation may deter some investors, it also presents a unique opportunity for those willing to embrace the risks associated with crypto investments. As the market evolves, FEAR will undoubtedly continue to be a subject of interest for investors seeking to navigate the complexities of the digital currency landscape.