H&T Group PLC: A Strategic Acquisition by FirstCash

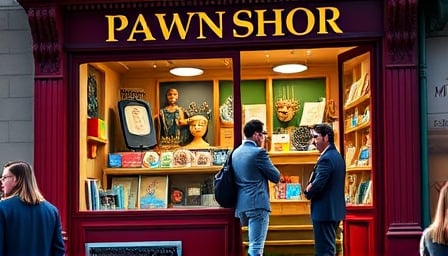

In a bold move that has sent ripples through the financial sector, FirstCash Holdings Inc. (FCFS) has announced its acquisition of H&T Group plc, the leading operator of pawnshops in the United Kingdom. This strategic acquisition, valued at a staggering £394 million, marks a significant expansion of FirstCash’s global footprint and underscores its ambition to dominate the consumer finance landscape.

A Game-Changing Deal

The acquisition, which was finalized on May 14, 2025, sees FirstCash taking over H&T Group, a company renowned for its comprehensive pawnbroking services, unsecured loans, check cashing services, and pre-paid debit cards. H&T Group, based in Sutton, United Kingdom, has been a staple in the consumer finance industry since its IPO on May 8, 2006. With a market capitalization of £19.88 billion and a close price of £458 as of May 12, 2025, H&T Group has demonstrated robust financial health and growth potential.

FirstCash’s Strategic Expansion

FirstCash’s acquisition of H&T Group is not just a financial transaction; it is a strategic maneuver aimed at bolstering its presence in the European market. By integrating H&T Group’s extensive network of pawnshops and its diverse range of financial services, FirstCash is poised to enhance its service offerings and capture a larger share of the consumer finance market in the UK and beyond.

Market Reactions and Implications

The financial community has reacted with keen interest to this acquisition. Analysts predict that this move will significantly enhance FirstCash’s competitive edge, allowing it to leverage H&T Group’s established brand and customer base. The deal is expected to drive synergies that will result in cost efficiencies and revenue growth for FirstCash.

Regulatory Disclosures

In line with regulatory requirements, several disclosures have been made following the acquisition. Form 8.5 (EPT/RI) was filed by Shore, an exempt principal trader with recognized intermediary status, dealing in a client-serving capacity. Additionally, Stellar Asset Management Ltd filed Form 8.3, disclosing a public opening position in H&T Group’s relevant securities.

Conclusion

The acquisition of H&T Group by FirstCash is a testament to the dynamic nature of the financial sector, where strategic acquisitions can redefine market landscapes. As FirstCash integrates H&T Group into its operations, the financial world will be watching closely to see how this bold move reshapes the consumer finance industry in the UK and sets the stage for future expansions.