Fractyl Health Inc. Faces Market Volatility Amid Nasdaq Listing

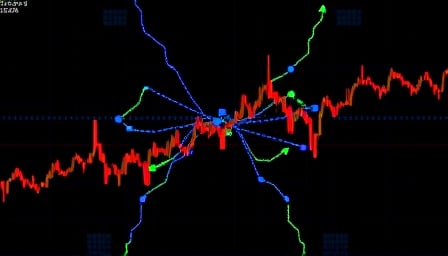

Fractyl Health Inc., a United States-based healthcare company, has recently been the subject of intense market scrutiny due to significant fluctuations in its stock price. Listed on the Nasdaq, the company’s stock has seen a rollercoaster ride over the past year, with a 52-week high of $7.89 and a low of $0.873. The recent close price of $1.28 marks a notable decrease from its peak, reflecting a decline in investor confidence.

The volatility in Fractyl Health’s stock price can be attributed to several factors. The company’s price-to-earnings ratio stands at -0.83, indicating that it is currently not generating profits. This negative ratio, coupled with a price-to-book ratio of 2.09, paints a complex picture of the company’s valuation. Investors are keenly watching these metrics to gauge the company’s financial health and future prospects.

Fractyl Health’s journey to the Nasdaq began with its listing on February 1, 2024. Since then, the company has been navigating the challenges of maintaining investor interest and stabilizing its stock price. The recent market performance suggests that further analysis is necessary to understand the underlying drivers of this volatility.

As Fractyl Health continues to operate within the dynamic healthcare sector, stakeholders are closely monitoring its strategic initiatives and financial performance. The company’s ability to address market concerns and capitalize on growth opportunities will be crucial in determining its future trajectory.

In conclusion, while Fractyl Health Inc. faces significant market volatility, its position in the healthcare sector offers potential for future growth. Investors and analysts will be watching closely as the company seeks to stabilize its stock price and build investor confidence in the coming months.