Freeport-McMoRan Inc.: A Strategic Outlook Amid Market Volatility

In the dynamic landscape of the metals and mining sector, Freeport-McMoRan Inc. has emerged as a focal point for investors and analysts alike. As of July 8, 2025, the company’s stock has been the subject of significant attention, with multiple financial institutions revising their price targets upward, signaling confidence in its near-term prospects.

Citi’s Optimism on Section 232 Benefits

Citi has notably raised its price target for Freeport-McMoRan to $48, attributing this adjustment to potential benefits from Section 232 tariffs. This legislative tool, which allows the U.S. government to impose tariffs on imports deemed a threat to national security, could bolster domestic copper production, a key area for Freeport-McMoRan. The anticipation of near-term upside, as echoed by both Citi and CFRA, underscores the strategic positioning of Freeport-McMoRan in the copper market, especially in light of possible tariffs on copper imports.

CFRA’s Elevated Price Target

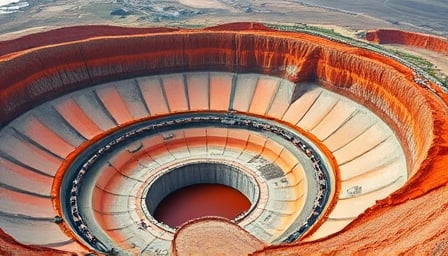

Further amplifying the bullish sentiment, CFRA has increased its price target for Freeport-McMoRan to $57 from $48. This adjustment reflects a broader market optimism about the company’s ability to capitalize on the tightening copper market. As the “Copper King,” Freeport-McMoRan’s extensive operations and strategic reserves position it uniquely to benefit from the current market dynamics.

Technical Strength and Market Performance

The company’s technical performance has also seen a positive trajectory, with IBD upgrading Freeport-McMoRan’s Relative Strength Rating. This improvement in price performance is a testament to the company’s resilience and strategic maneuvers in a volatile market environment.

Quarterly Earnings Anticipation

As Freeport-McMoRan prepares to disclose its quarterly earnings on July 23, 2025, the market is keenly watching. Analysts have set an average earnings per share (EPS) estimate of $0.442, a figure that will be pivotal in assessing the company’s financial health and operational efficiency in the recent quarter.

Market Volatility and Strategic Positioning

Despite the positive outlook from analysts, the broader market context presents challenges. Recent reports suggest that the market may have advanced too rapidly, with potential corrections on the horizon. This environment underscores the importance of Freeport-McMoRan’s strategic positioning and operational resilience.

Conclusion

In summary, Freeport-McMoRan Inc. stands at a critical juncture, with significant opportunities and challenges ahead. The company’s strategic focus on copper, coupled with favorable legislative and market conditions, positions it well for potential growth. However, the broader market volatility necessitates a cautious approach, with investors and stakeholders closely monitoring the company’s performance and strategic decisions in the coming months. As Freeport-McMoRan navigates these dynamics, its ability to leverage its strengths and adapt to market changes will be crucial in sustaining its momentum and achieving long-term success.