Galiano Gold Inc: A Golden Quarter Amidst Rising Costs

In a remarkable display of resilience and strategic prowess, Galiano Gold Inc. (GAU) has reported a stellar second quarter in 2025, marked by significant production growth and a surge in cash flow. Despite navigating the turbulent waters of rising costs and currency fluctuations, the company has not only maintained its momentum but has also seen its shares soar over 18% following the announcement of its strong Q2 results. This performance is a testament to Galiano Gold’s robust operational capabilities and its strategic positioning within the gold mining sector.

A Surge in Share Value

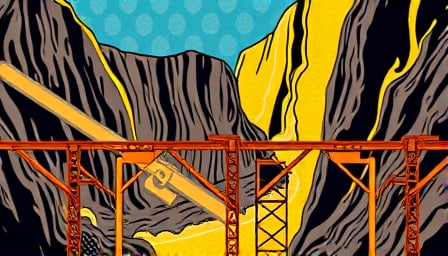

The financial markets have responded with enthusiasm to Galiano Gold’s Q2 2025 earnings call highlights, which underscored the company’s ability to achieve strong production growth amidst challenging economic conditions. The surge in Galiano Gold’s share value is a clear indicator of investor confidence in the company’s future prospects. This optimism is further fueled by the broader mining stock rally, driven by record gold prices that have analysts eyeing a $4,000 price target for gold. Galiano Gold, with its significant interest in the Asanko Gold Mine, stands to benefit immensely from this bullish gold market.

Navigating Rising Costs and Currency Fluctuations

Galiano Gold’s success in the second quarter of 2025 is particularly noteworthy given the backdrop of rising costs and currency fluctuations. The company’s ability to navigate these challenges while still achieving a revenue surge and strong earnings is a testament to its operational efficiency and strategic foresight. This performance not only highlights Galiano Gold’s resilience but also its potential to capitalize on the current gold market dynamics.

The Broader Gold Market Context

The global gold market is currently experiencing an unprecedented convergence of bullish forces, with major investment banks projecting gold prices to reach $4,000. This bullish outlook is driven by a combination of factors, including economic uncertainties and increased demand for gold as a safe-haven asset. Galiano Gold’s strong performance in this context is indicative of its strategic positioning and operational excellence, which are likely to serve it well as the gold market continues to evolve.

Conclusion

Galiano Gold Inc.’s remarkable performance in Q2 2025, characterized by strong production growth, a surge in cash flow, and a significant increase in share value, underscores the company’s resilience and strategic acumen. Despite the challenges posed by rising costs and currency fluctuations, Galiano Gold has not only navigated these headwinds successfully but has also positioned itself to capitalize on the bullish gold market. As the global gold market continues to exhibit strong bullish forces, Galiano Gold’s prospects appear brighter than ever, making it a compelling story in the materials sector and the broader mining industry.