Generation Mining Limited, a Canadian mineral exploration and development company, has recently been the subject of scrutiny due to its financial performance and strategic decisions. Based in Toronto and listed on the Toronto Stock Exchange, the company specializes in zinc-lead-silver and molybdenum deposits, offering its services to investors and partners within Canada. Despite its specialized focus, the company’s financial indicators and recent strategic moves have raised questions about its future trajectory.

As of the close of trading on January 4, 2026, Generation Mining’s stock was valued at CAD 0.84, reflecting a 12% decline from its 52-week high of CAD 0.92, achieved on December 23, 2025. This decline is significant, especially when contrasted with the stock’s 52-week low of CAD 0.105 on March 3, 2025. The current market capitalization stands at CAD 231,880,000, yet the company’s price-to-earnings ratio is a concerning -8.69, indicating that the company is not currently generating profits.

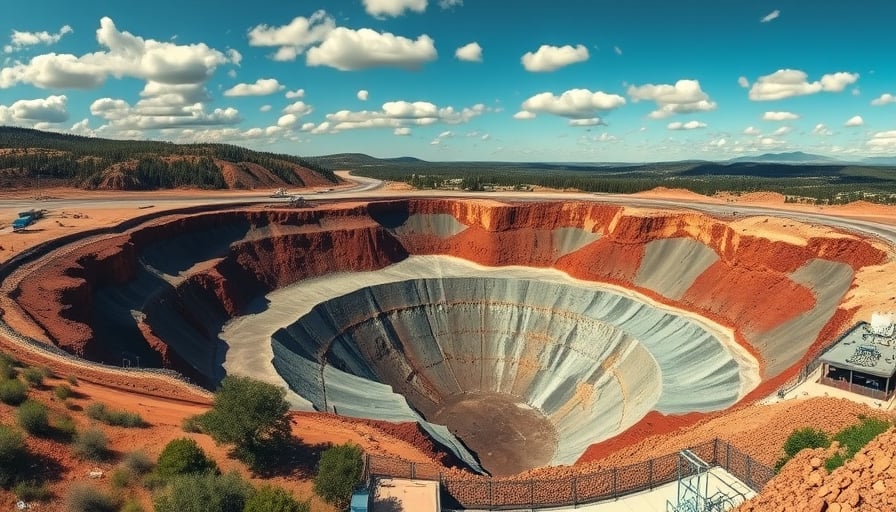

The most recent corporate update, dated December 10, 2025, highlighted the company’s expansion of a land package within the Marathon District. This move suggests a strategic focus on asset development, potentially aiming to capitalize on untapped mineral resources. However, the absence of new public disclosures since this announcement has left investors and analysts in the dark regarding the immediate operational impacts of this expansion.

The substantial price volatility observed over the past year underscores the inherent risks associated with Generation Mining’s operations. The stock’s significant fluctuation between its annual high and low points reflects the market’s uncertainty about the company’s ability to translate its strategic initiatives into tangible financial performance. This volatility is further exacerbated by the negative price-to-earnings ratio, which signals that the company is not currently profitable and may be facing challenges in achieving sustainable growth.

In conclusion, while Generation Mining Limited’s strategic expansion within the Marathon District indicates a commitment to asset development, the lack of recent public disclosures and the company’s negative financial indicators raise critical questions about its future prospects. Investors and stakeholders must remain vigilant, closely monitoring any forthcoming updates to assess the company’s ability to navigate the challenges ahead and achieve long-term success.