Ginlong Technologies Co Ltd: Navigating Market Volatility and Seizing Opportunities

In the dynamic landscape of the industrial sector, Ginlong Technologies Co Ltd, a prominent player in the electrical equipment industry, continues to make strategic moves amidst market fluctuations. As of September 1, 2025, the company’s stock closed at 67.98 CNY on the Shenzhen Stock Exchange, reflecting a significant recovery from its 52-week low of 43.44 CNY in April 2025. With a market capitalization of 270,637,769,16 CNY and a price-to-earnings ratio of 28.82778, Ginlong remains a key focus for investors and analysts.

Market Dynamics and Strategic Positioning

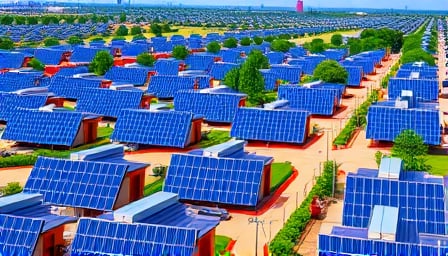

The A-share market has been experiencing heightened volatility, with the Shenzhen Composite Index and other major indices showing mixed performances. Despite this, certain sectors, including photovoltaic (PV) and semiconductor chips, have demonstrated resilience and growth. Ginlong, with its specialization in string inverters and other electrical equipment, is well-positioned to capitalize on these trends.

Photovoltaic Sector Surge

Recent reports highlight a strong performance in the photovoltaic sector, particularly in the inverter sub-index, which surged by 5.73%. Leading companies like Sunpower (300274) and Shenzhen Sunpower Electronics (300827) saw significant gains, with Sunpower’s shares jumping 15.30% and Shenzhen Sunpower Electronics hitting a 20% increase. This surge is attributed to robust demand and strategic positioning within the industry.

Supply Chain and Pricing Trends

The photovoltaic industry is currently witnessing a rise in silicon wafer and glass prices, driven by increased demand and supply constraints. This trend is expected to support higher pricing and profitability for companies like Ginlong, which are integral to the supply chain. The company’s ability to navigate these supply chain dynamics will be crucial in maintaining its competitive edge.

Strategic Opportunities and Challenges

As the market continues to adjust, Ginlong is advised to leverage structural opportunities by focusing on sectors like semiconductor chips and innovative pharmaceuticals. The company’s strategic investments in technology and innovation will be pivotal in sustaining growth amidst market volatility.

Conclusion

Ginlong Technologies Co Ltd is poised to navigate the complexities of the current market environment by leveraging its strengths in the photovoltaic sector and strategic supply chain positioning. With a focus on innovation and market opportunities, the company is well-equipped to maintain its growth trajectory and deliver value to its stakeholders. As the market evolves, Ginlong’s ability to adapt and seize opportunities will be key to its continued success.