Global Industrial Co: A Steady Presence in the Industrials Sector

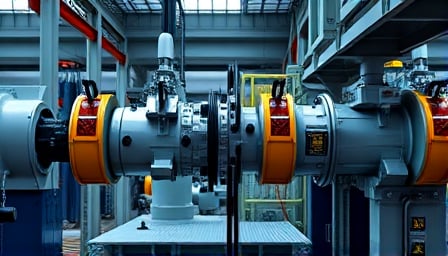

In the ever-evolving landscape of the industrials sector, Global Industrial Co. stands as a testament to resilience and adaptability. As a global distributor of industrial equipment, the company has carved out a significant niche for itself, offering a diverse range of products including electrical and lighting, fasteners and hardware, and more. With its operations spanning nationwide in the United States, Global Industrial Co. continues to cater to a broad spectrum of customer needs.

Financial Overview

As of July 31, 2025, Global Industrial Co. closed at $33.21, reflecting a recovery from its 52-week low of $20.79 in April 2025. The company’s market capitalization stands at $1.31 billion, with a price-to-earnings ratio of 19.83. These figures underscore the company’s robust financial health and investor confidence in its growth trajectory.

Market Movements and Strategic Insights

While Global Industrial Co. maintains its steady course, the broader financial landscape is witnessing significant developments. Notably, Singapore’s GIC Pte Ltd has emerged as a leading bidder for a substantial minority stake in a Spanish broadband joint venture. This move highlights GIC’s strategic interest in expanding its footprint in the telecommunications sector, a trend that could have ripple effects across related industries.

In parallel, the asset reconstruction landscape in India is witnessing a pivotal moment with Arcil, backed by Avenue Capital Group, filing preliminary IPO papers. This marks a significant step for Arcil as it seeks to raise funds through an initial share sale, potentially setting a precedent for other asset reconstruction companies.

Industry Developments

The industrials sector is also seeing strategic expansions and partnerships. Kite Realty Group, for instance, has raised its 2025 core FFO guidance and expanded its joint venture with GIC to $1 billion, accelerating anchor leasing efforts. Such strategic moves are indicative of the sector’s dynamic nature and the continuous search for growth opportunities.

Conclusion

Global Industrial Co. remains a key player in the industrials sector, with its diverse product offerings and strong market presence. As the company navigates through a landscape marked by strategic investments and industry shifts, its focus on meeting customer needs and maintaining financial stability positions it well for future growth. Investors and industry watchers will undoubtedly keep a close eye on how these developments unfold and their potential impact on Global Industrial Co.’s trajectory.