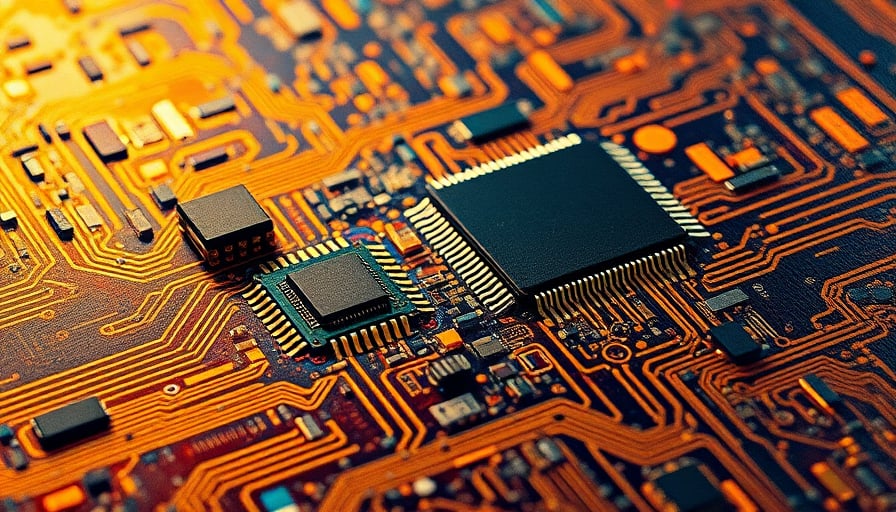

GSI Technology Inc., a prominent player in the semiconductor industry, has recently been the subject of market attention due to its performance and strategic positioning within the information technology sector. Based in Sunnyvale, GSI Technology Inc. specializes in the design, development, and marketing of high-performance SRAM integrated circuits. These circuits are crucial for networking and telecommunications applications, underscoring the company’s role in supporting the backbone of modern communication infrastructure.

As of December 23, 2025, GSI’s stock closed at $6.12, reflecting a significant fluctuation over the past year. The stock reached a 52-week high of $12.97 on October 19, 2025, and a low of $1.62 on April 6, 2025. This wide range highlights the volatility and investor sentiment surrounding the company, influenced by market dynamics and the company’s operational performance.

The company’s market capitalization stands at approximately $213.39 million, indicating its size and influence within the semiconductor equipment industry. Despite its substantial market presence, GSI’s financial metrics reveal a challenging earnings landscape. The price-to-earnings ratio is currently at -13.64, a figure that underscores the company’s negative earnings profile. This metric is often indicative of companies experiencing significant operating losses or undergoing transitional phases, where earnings are not yet positive.

In contrast, GSI’s price-to-book ratio is 5.43, suggesting that the company trades well above its book value. This discrepancy between the price-to-earnings and price-to-book ratios is not uncommon for companies in the technology sector, particularly those investing heavily in research and development or those navigating through periods of strategic realignment.

In recent developments, GSI Technology Inc. made a brief appearance at the 28th Annual Needham Growth Conference, held virtually on December 18, 2025. This participation highlights the company’s ongoing efforts to engage with investors and stakeholders, seeking to communicate its strategic vision and operational goals amidst a challenging market environment.

As GSI Technology Inc. continues to navigate the complexities of the semiconductor industry, its focus remains on leveraging its expertise in SRAM technology to meet the evolving demands of networking and telecommunications sectors. The company’s ability to innovate and adapt will be crucial in determining its future trajectory and financial health. Investors and market analysts will closely monitor GSI’s progress, particularly in terms of achieving positive earnings and stabilizing its stock performance.