Hangzhou Cable Co Ltd (603618) – Trading Activity and Market Context (September 2025)

Company background

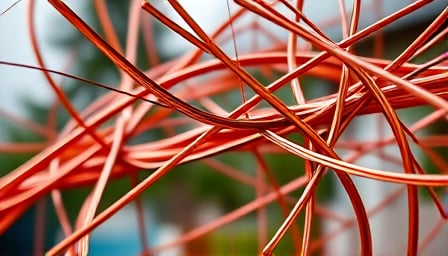

Hangzhou Cable Co Ltd, listed on the Shanghai Stock Exchange under the ticker 603618, specializes in the manufacturing of wire and cables. Its product portfolio includes aluminum‑alloy conductors, overhead wires, middle‑low‑power cables, and special power cables, which are sold globally. The company’s market capitalization is CNH 4,660,000,000, and its price‑to‑earnings ratio is 42.453.

Trading performance on 17 September 2025

- Close price: CNH 8.35, an increase of 10.01 % from the previous trading day.

- Volume: 17.69 % of the daily turnover was attributable to the stock, with 974.77 k shares (≈3 % of the float) trading at the limit‑up price.

- Limit‑up duration: The stock remained at the upper price bound for 3 h 59 m 42 s before closing.

- Largest block trade: 1.383 million shares, representing the highest buy order seen at the limit‑up price.

The 10 % price increase was driven by a combination of sectoral themes—intelligent grid, optical fiber, and copper foil—and the release of the company’s half‑year earnings report on 16 September. The earnings announcement cited strong demand from national grid operators and the ongoing development of a lightweight copper‑foil project for new‑energy vehicles.

Regulatory and corporate disclosures

- Abnormal price movement: On 17 September, the company’s stock was flagged for abnormal price movement. The company issued a notice confirming that its day‑to‑day operations were normal, no material information had been withheld, and no significant changes occurred in its operating environment. The notice urged investors to exercise caution and to invest rationally.

- Investigation correspondence: A formal response was submitted to the controlling shareholder and actual controller, confirming compliance with disclosure obligations and the absence of undisclosed material events.

Market‑wide context

- Indices: The Shanghai Composite Index fell 1.15 % to 3,831.66 points; the Shenzhen Component Index fell 1.06 % to 13,075.66 points.

- Volume: Total trading volume for the Shanghai and Shenzhen exchanges reached CNH 3.135 trillion, a 7.6 billion‑currency‑unit increase from the previous day.

- Sector activity: The “copper cable high‑speed connection” concept rose in prominence, and the “intelligent grid” theme attracted attention due to several stocks in the segment, including Hangzhou Cable, recording significant price gains.

- Limit‑up environment: A total of 65 stocks hit the limit‑up threshold on 18 September (the day after Hangzhou Cable’s limit‑up), reflecting a market‑wide surge in investor sentiment.

Trading implications

- Liquidity: The high trading volume and significant block trades during the limit‑up period suggest robust liquidity for Hangzhou Cable.

- Volatility: The abnormal price movement notice signals that the stock is subject to heightened market scrutiny; investors should monitor regulatory updates and earnings releases closely.

- Strategic positioning: The company’s focus on intelligent grid and copper‑foil products aligns with broader national initiatives in power grid modernization and electric‑vehicle manufacturing, potentially supporting future revenue growth.

This article presents factual information extracted from the provided financial news and company fundamentals. No speculative commentary is included.