Hanwha Systems Co Ltd: A Quarter of Mixed Signals

In a recent financial disclosure, Hanwha Systems Co Ltd, a South Korean powerhouse in electronic components and systems, unveiled its latest quarterly results. The company, established in 1952, has long been recognized for its innovative and high-quality products serving both automotive and non-automotive industries. However, the latest figures paint a picture of a company at a crossroads.

For the quarter ending March 31, 2025, Hanwha Systems reported a profit of 200.27 KRW per share, a noticeable decline from the 276.37 KRW per share in the same quarter of the previous year. Despite this dip in earnings per share, the company managed to boost its revenue by 26.77% year-over-year, reaching 690.10 billion KRW from 544.36 billion KRW. This revenue growth, while commendable, raises questions about the sustainability of profit margins and the company’s ability to navigate the challenges ahead.

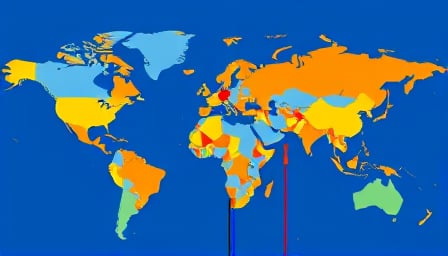

The broader market context in which Hanwha Systems operates is equally complex. Asian markets, including Seoul, have shown resilience, with the Kospi index recovering to a 0.4% gain after initial losses. This recovery is partly buoyed by positive cues from the US markets, which managed to offset earlier losses. However, the anticipation of new economic stimuli from Beijing remains unmet, casting a shadow over the Chinese markets, which have remained largely unchanged.

The ongoing US-China trade tensions continue to loom large, with over 100% mutual tariffs in place. Economists from Nomura estimate that approximately 2.2% of China’s GDP is directly impacted by US tariffs, potentially costing China about 1.1% of its GDP in the short term. The actual economic toll could be even more significant, suggesting a challenging environment for companies like Hanwha Systems that operate within these geopolitical tensions.

With a market capitalization of 7.33 trillion KRW and a price-to-earnings ratio of 15.02, Hanwha Systems stands at a pivotal moment. The company’s ability to leverage its strong reputation and innovative edge will be crucial in navigating the uncertain waters ahead. As the global economic landscape continues to evolve, stakeholders will be watching closely to see how Hanwha Systems adapts to these challenges and opportunities.

In conclusion, while Hanwha Systems has demonstrated resilience in revenue growth, the decline in earnings per share and the broader economic uncertainties present a complex scenario. The company’s future trajectory will depend on its strategic responses to both internal challenges and external pressures, including geopolitical tensions and market dynamics. As the situation unfolds, the financial community will be keenly observing Hanwha Systems’ next moves.