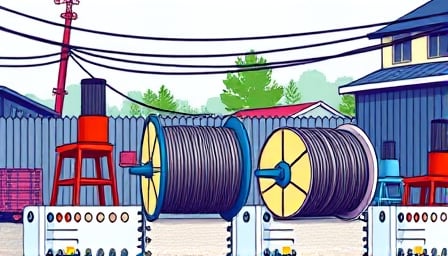

Henan Tong-Da Cable Company Limited, a prominent player in the electrical equipment sector, has recently been the subject of considerable attention in the financial markets. Listed on the Shenzhen Stock Exchange, the company specializes in the development, production, and sale of a diverse range of cables, including aluminium conductor steel reinforced cables, aluminium alloy conductor cables, and aluminium alloy steel reinforced cables. These products are integral to various industrial applications, underscoring the company’s pivotal role in the sector.

As of September 11, 2025, Tong-Da Cable’s stock closed at 7.41 CNY, reflecting a notable recovery from its 52-week low of 4.96 CNY, recorded on September 17, 2024. This resurgence is indicative of the company’s robust operational strategies and its ability to navigate market fluctuations effectively. The stock reached a 52-week high of 10 CNY on May 18, 2025, highlighting a period of significant investor confidence and market optimism.

With a market capitalization of approximately 3.90 billion CNY, Tong-Da Cable’s financial standing is substantial within the industrials sector. However, the company’s price-to-earnings ratio stands at 77.30506, suggesting a premium valuation that investors attribute to its growth potential and strategic market positioning. This valuation reflects the market’s anticipation of sustained demand for its specialized cable products, driven by global infrastructure development and technological advancements.

Tong-Da Cable’s strategic focus on innovation and quality has enabled it to maintain a competitive edge in the electrical equipment industry. The company’s commitment to research and development ensures that its product offerings remain at the forefront of technological advancements, catering to the evolving needs of its diverse clientele.

Looking ahead, Tong-Da Cable is poised to capitalize on emerging opportunities within the global market. The increasing demand for high-performance cables in sectors such as renewable energy, telecommunications, and transportation infrastructure presents significant growth prospects. The company’s strategic initiatives are likely to focus on expanding its product portfolio and enhancing its manufacturing capabilities to meet these burgeoning demands.

In conclusion, Henan Tong-Da Cable Company Limited continues to demonstrate resilience and strategic foresight in a dynamic market environment. Its strong financial metrics, coupled with a commitment to innovation, position the company favorably for future growth. Investors and industry stakeholders will undoubtedly keep a close watch on Tong-Da Cable’s trajectory as it navigates the opportunities and challenges of the coming years.