Henghe Mould’s Strategic Growth and Market Performance

In a remarkable display of strategic growth and market performance, Henghe Mould, a prominent player in the materials sector, particularly in chemicals, has been making headlines. Listed on the Shenzhen Stock Exchange, the company has seen its stock price reach a historical high, closing at 24.77 CNY on July 28, 2025. This marks a significant milestone, considering the stock’s 52-week high of 28 CNY and a low of 7.22 CNY back in August 2024. With a market capitalization of 2.48 billion CNY and a price-to-earnings ratio of 79.57, Henghe Mould’s financial health and investor confidence are evident.

Innovative Applications and Strategic Partnerships

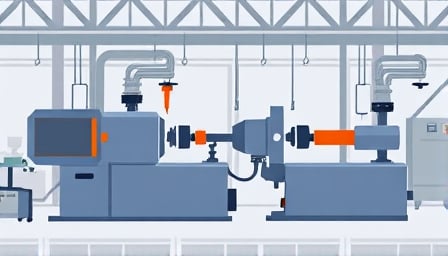

Henghe Mould’s recent investor relations activities have shed light on its innovative applications of PEEK materials, primarily in smart home appliances and automotive components such as 3D fans and gears. The company, established in 2001 and listed on the Shenzhen Stock Exchange in 2016, has developed three major manufacturing bases in Ningbo, Jiaxing, and Dongguan. Its smart home appliances business, accounting for over 58% of its 2024 revenue, remains a cornerstone, with strategies focused on binding top-tier clients and optimizing product structures. The automotive components segment, however, is identified as the main growth engine, with Henghe Mould implementing a dual strategy for Tier1 and Tier2 business models.

In the Tier1 domain, the company leverages its expertise in plastic substitution for steel and integrated steel-plastic technologies, targeting downstream OEM clients with products like CCB steel-plastic integrated beams and all-plastic front-end modules. Strategic partnerships with leading automotive manufacturers such as SAIC Volkswagen, BYD, Geely, Zotye, and SAIC Passenger Vehicle underscore its market penetration and growth potential.

The Tier2 strategy focuses on precision injection molding, targeting multi-component injection molded copper-plated gears, gearboxes, and gears. Collaborations with industry leaders like Yinfeng, Huawei, and Fudi highlight its commitment to platform-based product development as a key growth driver.

Market Performance and Future Outlook

Henghe Mould’s stock performance has been impressive, with a 237.24% increase over the past year, significantly outpacing the Shenzhen 300 Index’s 21.31% rise. The company’s strategic focus on high-torque automotive transmission actuators, exemplified by the successful mass production of a high-torque door actuator in 2024, lays a solid foundation for its rapid growth in the automotive components segment.

The broader market has also shown a positive trend towards machine learning and PEEK material concept stocks, with Henghe Mould among the stocks experiencing over 10% growth. This is in line with the industry’s move towards innovative applications, as seen with the launch of UnitreeR1, a humanoid robot by Yushu Technology, indicating a growing interest in advanced materials and robotics.

Conclusion

Henghe Mould’s strategic initiatives in smart home appliances and automotive components, coupled with its robust financial performance and strategic partnerships, position it well for sustained growth. As the company continues to innovate and expand its market presence, it remains a key player to watch in the materials and chemicals sector.