Hengtong Optic‑electric Co Ltd – Market Context and Recent Activity

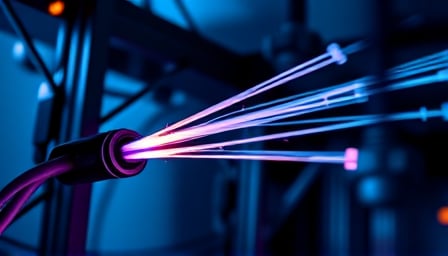

Hengtong Optic‑electric Co Ltd (Ticker: 600487, Shanghai Stock Exchange) is a Suzhou‑based information‑technology firm that specializes in the manufacturing of optical fibers, electrical fibers, rail‑transit cables, and related solutions. The company serves a broad range of sectors, including big data, smart ocean, quantum communication, and electricity infrastructure. As of 16 September 2025, the closing price of the shares was 20.20 CNH, with a market capitalization of 46.62 billion CNH. The 52‑week high and low were 22.01 and 13.86 CNH, respectively, and the price‑earnings ratio stood at 16.34.

Trading Environment on 18 September 2025

- The Shanghai Composite Index closed at 3,831.66 points, down 1.15 %.

- Total market turnover for the day was approximately 3.14 trillion CNH, an increase of 758.4 billion CNH from the previous session.

- Net outflows of institutional capital were 128.27 billion CNH, with the largest inflows concentrated in the tourism‑hotel, automotive‑service, and pharmaceutical‑business sectors.

Activity of Hengtong Optic‑electric Shares

- Trading volume: Shares of Hengtong Optic‑electric experienced a sharp increase in turnover during the day, with a total volume of 3.16 billion CNH, representing 3.16 % of the daily traded value.

- Price movement: The stock closed at 22.22 CNH, a 10.00 % gain from the open price, and hit the daily limit upward (涨停) at 9:46 a.m. Local time.

- Limit‑up characteristics: The limit‑up was sustained for 3 hours 42 minutes, during which the highest order block reached 5,264.41 million CNH. The block of orders that maintained the limit accounted for 598.57 million CNH, equivalent to 0.34 % of the free‑float shares and 3.16 % of the day’s total trading volume.

- Underlying drivers: The upward move was attributed to a combination of factors: the launch of new high‑performance optical fiber products, the integration of these products into robotics and marine applications, and strong quarterly earnings growth.

Sectoral Context

- F5G concept: The F5G concept sector rose 1.45 %, with 19 stocks posting gains. Key contributors included DeCO Ltd (20 % limit‑up), Fenghuo Communication, and Hengtong Optic‑electric, which all reached limit‑up status.

- CPO and AI‑related concepts: The CPO (Common Package Optics) and AI industry‑chain stocks remained active, with multiple limit‑up occurrences. Hengtong Optic‑electric’s involvement in high‑speed optical modules aligns it with the broader AI communication trend.

Analyst Coverage

- Institutional ratings: On 18 September, 39 stocks received buy‑rating reports, and 12 stocks were flagged as new interests. Although Hengtong Optic‑electric was not listed among those receiving a new buy rating, the overall positive market sentiment toward optical‑communication and robotics stocks suggests a favorable outlook for the company.

Summary

On 18 September 2025, Hengtong Optic‑electric Co Ltd executed a significant price increase, closing at a daily limit‑up of 22.22 CNH. The move was supported by strong institutional buying, a broader rally in the F5G and CPO sectors, and the company’s continued product innovation in optical fiber solutions. The stock’s performance was consistent with the broader trend of optimism in technology and industrial‑automation sectors, despite a net outflow of institutional capital across the market.