Trading Highlights – 12 February 2026

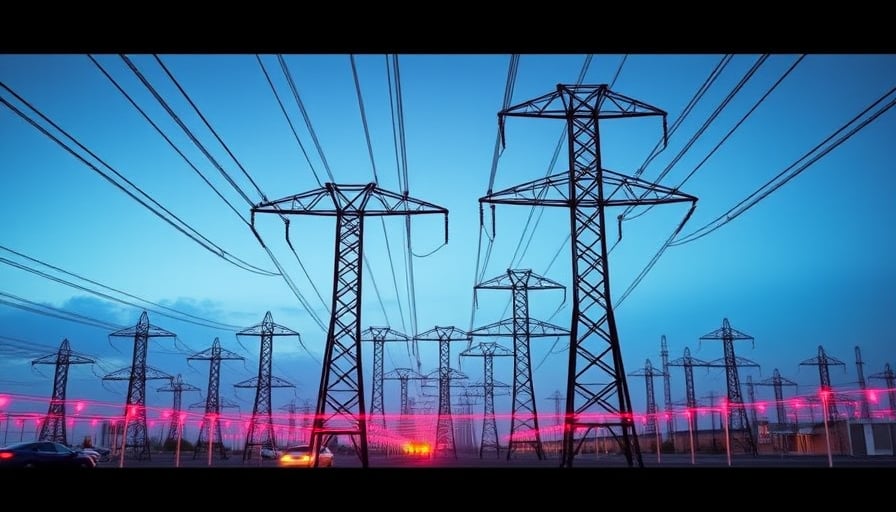

Market context A‑share indices posted modest gains: the Shanghai Composite rose 0.12 %, the Shenzhen Component climbed 0.80 %, and the ChiNext index advanced 1.18 %. The power‑equipment sector led the session, with several constituent stocks hitting the daily price ceiling.

HLGF (Qingdao Hanhe Cable Co.) performance The shares of Qingdao Hanhe Cable Co Ltd. (HLGF) surged to the 4‑share limit, recording a 4‑consecutive‑board (four‑day streak of price ceilings). The closing price on 8 January 2026 was CNY 4.01, while the 52‑week high reached CNY 4.22; the current price thus represents a strong near‑peak movement within the year’s range.

Drivers of the rally

- Policy support for the national power‑grid – the State Council released an implementation opinion on building a unified national power‑market system, targeting full construction by 2035.

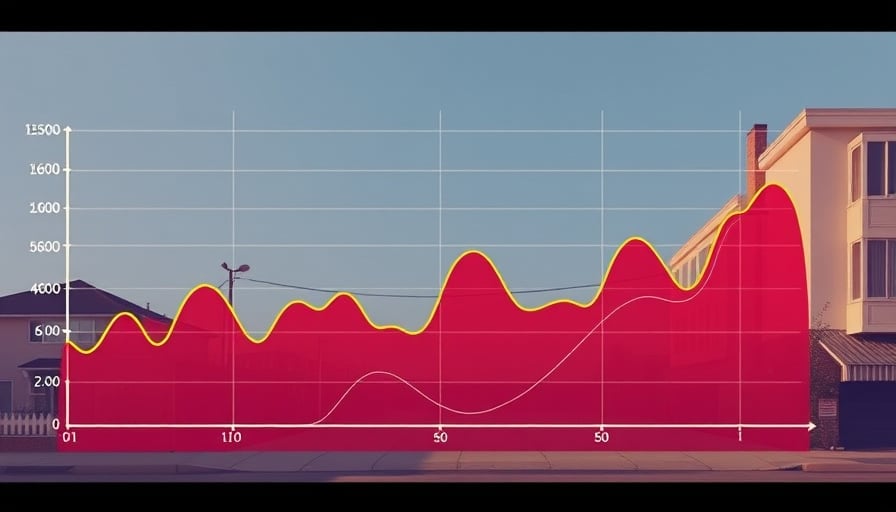

- Investment momentum – forecasts indicate that fixed‑asset investment in the power grid will reach CNY 4 trillion (2026‑2030) and CNY 1.8 trillion (2026) for the State Grid and China Southern Grid respectively, signalling sustained demand for grid equipment.

- High‑voltage expansion – the high‑voltage concept has gained traction, with several leading manufacturers (e.g., Hanhe Cable, Zhongheng Electric, Sifang Co.) posting multiple daily limit‑ups.

- Export opportunities – China’s transformer export value hit a record CNY 64.6 billion in 2025, a 36 % rise from the previous year, reflecting overseas demand for high‑quality electrical equipment.

Sector‑wide activity Other power‑equipment names that participated in the limit‑up wave include Zhongheng Electric, Sifang Co., Wangbian Electric, Shun Nan Co., and Senyuan Electric. The broader industry sentiment was buoyed by expectations of increased investment in grid modernization and the expansion of ultra‑high‑voltage transmission projects.

Implications for HLGF

The sustained limit‑up indicates strong investor confidence in the company’s product portfolio, which includes optical fiber, submarine cables, communication data cables, and branch cables, as well as installation and troubleshooting services.

HLGF’s listing on the Shenzhen Stock Exchange and its active participation in the high‑voltage equipment supply chain position it to benefit from the projected growth in grid infrastructure and overseas export demand.

Analysts will likely focus on the company’s ability to maintain its market share amid increasing competition and to capitalize on the policy‑driven demand for advanced cable technologies.

Summary HLGF’s 4‑day consecutive limit‑ups are part of a broader power‑equipment sector rally driven by supportive policy, escalating domestic grid investment, and growing export opportunities. The company’s share price has approached its annual high, reflecting strong market expectations for continued demand for its cable products and related services.