Holcim AG’s Stock Performance Amidst Market Uncertainty

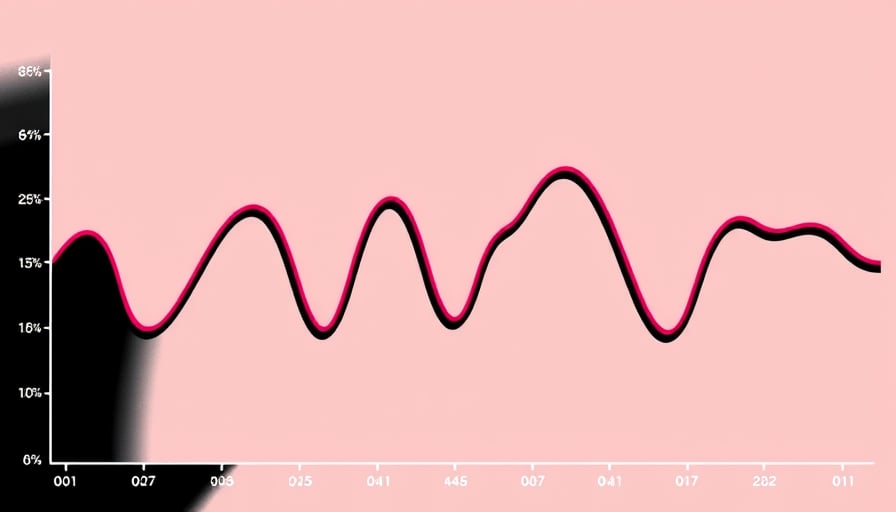

Holcim AG (ticker HOLC), the Swiss construction‑materials giant, has experienced a pronounced volatility in its share price over the past two weeks, despite the company’s continued delivery of stable earnings and a clear strategic emphasis on green building solutions. The most recent trading session on 15 February 2026 saw the stock finish at CHF 69.92, a noticeable decline from the 52‑week high of CHF 101.95 set on 5 March 2025, yet still above the 52‑week low of CHF 46.64 recorded on 18 June 2025.

1. Earnings Stability vs. Market Sentiment

According to a local news report dated 15 February 2026, Holcim “delivers stable numbers, sets focus on green building materials – yet the market remains hesitant.” This assessment aligns with the company’s latest quarterly results, which showed consistent revenue growth driven by demand for ready‑mixed concrete, cement, and clinker. While earnings have not surged dramatically, the company’s price‑to‑earnings ratio of 14.93 indicates that investors are still pricing in future growth prospects rather than reacting solely to current profitability.

2. Green Building Materials and Risk Mitigation

Another article, dated 15 February 2026, highlighted Holcim’s cement products as a means to transform construction projects from “risk to a safe bank.” The emphasis on high‑performance concrete and other low‑carbon solutions positions Holcim as a key player in the EU’s decarbonisation push. Nevertheless, the market’s reluctance to fully embrace this narrative may stem from broader macro‑economic factors, including tightening monetary policy and concerns about the pace of renewable‑energy deployment across Europe.

3. Strategic Acquisitions and Expansion in Italy

On 12 February 2026, Holcim completed the acquisition of Calcestruzzi Erbesi in Lombardy, adding three production plants in Galbiate, Albate, and Uboldo to its portfolio. This move was intended to strengthen Holcim’s presence in the Italian market and expand its production capacity. While the acquisition is a strategic win, the immediate impact on share price has been muted, as the company’s broader valuation is influenced by global supply‑chain dynamics and commodity price swings.

4. Market Pressure from Regulatory and Investor Actions

The Swiss equity market’s overall sentiment on 12 February 2026 was bearish, with Holcim’s shares under pressure due to “profit‑taking and regulatory scrutiny.” A series of articles from finanzen.net and cash.ch underscored the role of sell‑offs and the weight of new EU carbon‑pricing regulations, which have temporarily depressed the price of CO₂ certificates. The sharp fall in CO₂‑certificate prices, reported on 15 February 2026 by faz.net, directly affected Holcim’s cost structure and investor perception of its future profitability.

5. Broader Economic Context

Holcim’s performance must also be viewed within the context of the Swiss market’s modest gains on 13 February 2026. The Swiss Market Index (SMI) finished the day at 13,625.55 points, up 0.71 %. While the SMI showed resilience, individual stocks such as Holcim were dragged down by sector‑specific concerns rather than a general market downturn.

6. Outlook

Looking ahead, Holcim’s continued focus on green building materials, coupled with its recent acquisition in Italy, positions it favorably for long‑term growth. However, short‑term market volatility is likely to persist as investors digest regulatory changes and the evolving landscape of CO₂ pricing. The company’s market capitalisation of approximately CHF 38.5 billion and its current trading price suggest that the stock may still offer value to investors willing to endure the present uncertainty in pursuit of a sustainable construction‑materials leader.