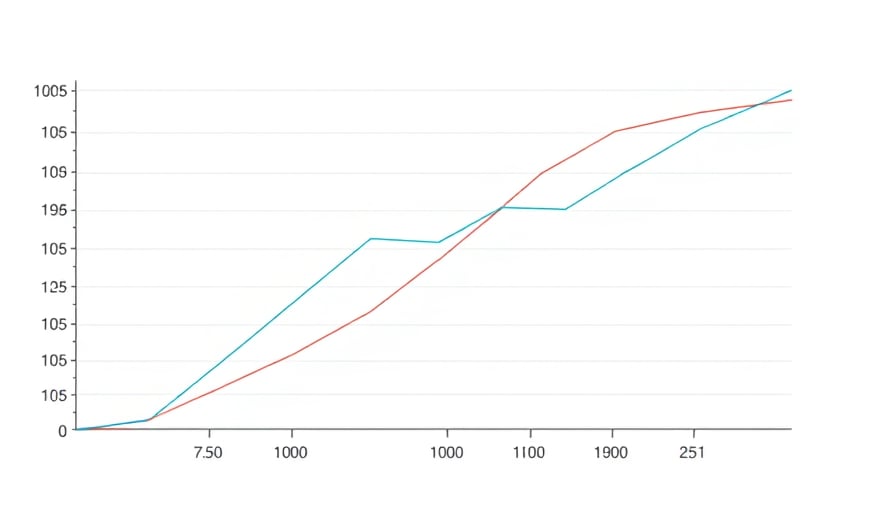

In the ever-evolving landscape of cryptocurrency, Beldex has emerged as a focal point of discussion among investors and analysts alike. As of January 22, 2026, Beldex’s close price stood at $0.0849376, a figure that, while seemingly modest, belies the tumultuous journey this digital asset has undergone over the past year. With a 52-week high of $0.104986 and a low of $0.0583382, Beldex’s volatility is not just a statistic; it is a testament to the unpredictable nature of the crypto market.

The market capitalization of Beldex, currently at $640,474,653.451 USD, positions it as a significant player within the cryptocurrency arena. However, this valuation prompts a critical examination of the factors contributing to its current standing. Is Beldex’s market cap a reflection of its intrinsic value, or is it merely a byproduct of speculative trading?

The fluctuations in Beldex’s price over the past year raise pertinent questions about the stability and reliability of cryptocurrencies as a whole. The stark contrast between its 52-week high and low underscores the inherent risks associated with investing in digital currencies. Investors are left to ponder whether Beldex’s current valuation is a harbinger of future growth or a prelude to further decline.

Moreover, the broader implications of Beldex’s performance cannot be overlooked. As cryptocurrencies continue to challenge traditional financial systems, the volatility of assets like Beldex serves as a reminder of the nascent and experimental nature of this market. The question remains: can Beldex, and cryptocurrencies in general, mature into stable and reliable financial instruments, or will they remain subject to the whims of market speculation?

In conclusion, Beldex’s journey over the past year is emblematic of the broader challenges facing the cryptocurrency market. Its current valuation, while significant, is but a snapshot in time, subject to the ever-changing dynamics of investor sentiment and market forces. As the crypto landscape continues to evolve, Beldex’s future remains uncertain, a reflection of the broader quest for stability and legitimacy in the world of digital currencies.