Impact of Rising Korean Ship‑building Orders on the US Dollar/Korean Won

The Korean ship‑building sector has recorded an 8 % increase in orders for 2025, bringing the country’s share of global orders to 20.6 %. The growth is largely attributed to a reduction in Chinese orders, which fell by more than 35 % to 3,536 million CGT. The widening gap between the United States and China in ship‑building activity has implications for the Korean Won against the US dollar.

Current FX Position

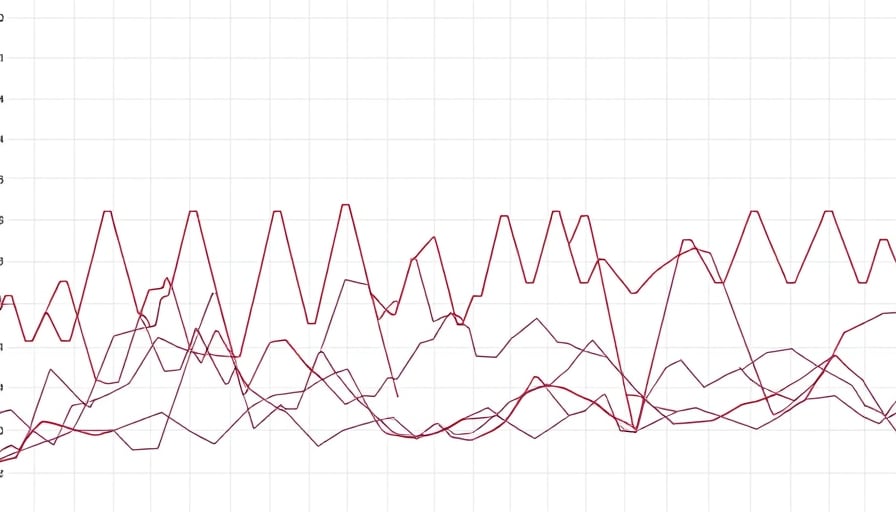

On 12 February 2026 the US dollar was quoted at KRW 1,440.9 on the IDEAL PRO platform. Over the last 12 months the pair has ranged from a 52‑week low of KRW 1,322.42 (27 November 2025) to a 52‑week high of KRW 1,486.9 (8 April 2025). The recent rise in Korean export earnings, especially from the ship‑building sector, provides a supporting backdrop for the Won.

Sectoral Drivers

- Ship‑building Orders

- Korean orders increased to 1,159 million CGT, a 10 % rise from 2024.

- The sector’s share of global orders climbed from 18 % to 20.6 %.

- The 7‑percentage‑point increase in market share is the largest in the region for the year.

- Global Demand Dynamics

- Global ship‑building demand fell by 27 % from 2024 to 2025.

- China’s decline of 35 % has opened a larger share of the market for Korea.

- Japan’s decline of 53 % further consolidates Korea’s relative position.

- Implications for the Won

- Higher export receipts bolster foreign‑exchange inflows.

- A stronger Won is likely to support the dollar/Won pair, as demand for the Won rises from Korean exporters.

- The sector’s growth may offset pressure on the Won from other domestic factors, such as monetary policy decisions or commodity price fluctuations.

Market Context

- Asia Stock Markets – The broader Asian markets experienced a modest pullback after a strong week, reflecting concerns in the United States and a cautious stance from investors.

- Other Asian Currencies – While the Malaysian ringgit reached a new high against the dollar, the Korean won moved within its historical range, showing resilience amid regional volatility.

- US Market Conditions – A decline in US equities, coupled with the holiday closures around the Presidents’ Day, contributed to a more conservative risk appetite in Asia.

Conclusion

The 8 % rise in Korean ship‑building orders and the subsequent increase in market share are positive catalysts for the Korean Won. When considered alongside the current USD/KRW level of 1,440.9 and the recent 52‑week range, market participants should anticipate a potential stabilisation or modest appreciation of the won, contingent on broader global demand and domestic policy developments.