Midea Group Co Ltd: Recent Developments and Market Reaction

Midea Group Co Ltd, a leading Chinese manufacturer of household appliances and related technologies, has announced a series of significant corporate actions and product innovations in the past week. The company’s share price, market capitalization, and investor sentiment have all been influenced by these events.

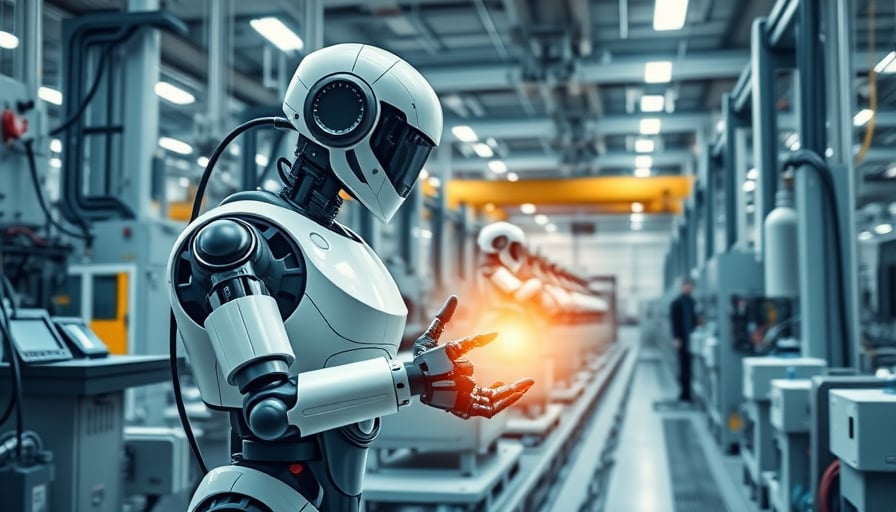

Product Innovation: MIROU Super Humanoid Robot

On December 9, 2025, Midea Group unveiled the MIROU super‑humanoid robot, described as featuring “6‑armed coordination for rapid module switching.” The robot is positioned as a next‑generation automation platform that could extend Midea’s reach into advanced robotics and industrial automation. While the announcement generated media coverage, no financial impact on the company’s earnings or cash flows was disclosed in the press release.

Share Price Performance

- Closing price (12 Dec 2025): HKD 88.9, down from the 52‑week high of HKD 92.15.

- Market capitalization: Approximately HKD 683.17 billion.

- Price‑to‑earnings ratio: 13.42.

The stock experienced a modest decline on the day the MIROU announcement was released, falling ‑1.71 % to HKD 86.7. This drop is consistent with the broader market reaction to the announcement of the robot, as well as a slight correction from the recent rally.

Share Buyback and Capital Reduction

On December 8, 2025, Midea Group announced a share‑buyback program worth HKD 10 billion (≈US$1.28 billion). The program involved the repurchase of 135 million shares, of which 95 million were subsequently cancelled to reduce the company’s registered capital. The cancelled shares represented 1.24 % of the pre‑buyback share capital.

Key details of the buyback:

| Item | Value |

|---|---|

| Total repurchase amount | HKD 10 billion |

| Shares repurchased | 135 million |

| Shares cancelled | 95 million |

| Proportion of cancelled shares | 1.24 % of pre‑buyback capital |

| Highest transaction price | HKD 83.11 |

| Lowest transaction price | HKD 69.91 |

| Average transaction price | HKD 80.12 (approx.) |

The buyback was financed through the company’s cash reserves. Following the announcement, the stock opened at HKD 88.4, reflecting a ‑0.27 % decline, and later traded within a narrow range before closing at HKD 88.9.

Earnings Highlights

Midea Group’s latest quarterly report (Q3 2025) reported:

- Operating revenue: HKD 364.72 billion (up 13.8 % YoY).

- Net profit attributable to parent: HKD 37.88 billion (up 19.5 % YoY).

- Quarterly revenue: HKD 112.4 billion (surpassing HKD 100 billion for the first time in a single quarter).

These results reinforce the company’s robust growth trajectory, which is reflected in the relatively low price‑to‑earnings ratio of 13.42.

Market‑Wide ETF Impact

The 159936 and 562580 consumer‑discretionary ETFs, which hold Midea Group as a significant position, recorded intraday declines of ‑0.27 % and ‑0.38 %, respectively, on December 10, 2025. The ETFs’ performance underscores the market’s cautious stance following the combined effect of the MIROU launch and the share‑buyback announcement.

Summary

Midea Group’s recent actions—launching an advanced humanoid robot, executing a sizeable share‑buyback and capital reduction, and reporting strong earnings—have positioned the company as a dynamic player in both consumer electronics and emerging technology sectors. The stock has responded moderately to these developments, with a slight decline in price but maintaining a solid valuation profile supported by strong earnings growth.