Mosaic Co: Market Update and Q4 2025 Outlook

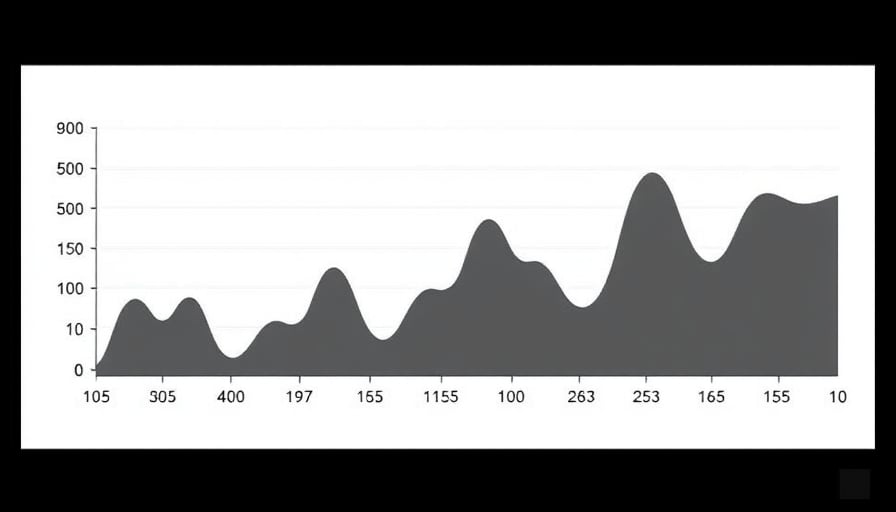

Mosaic (NYSE: MOS) traded down on Friday after management released a brief commentary on fourth‑quarter free‑cash‑flow figures. The shares fell from a 52‑week low of $22.36 to a closing price of $26.35 on 15 January 2026, reflecting a broader cautionary tone that has permeated the U.S. equity market over the past week. The company’s price‑earnings ratio of 6.79 remains attractive relative to the broader materials sector, but investors are keeping a close eye on the company’s cash‑flow trajectory as it navigates a tightening North American fertilizer demand environment.

Q4 2025 Sales Update

In a market update released at 10:48 a.m. EST, Mosaic disclosed preliminary sales figures for the fourth quarter of 2025. While the company did not provide a full earnings report at this stage, the update confirmed that sales are in line with guidance issued earlier in the year. Mosaic’s management highlighted that the company’s core product mix—feed ingredients, crop nutrients, industrial products, concentrated phosphates, and potash—continues to support stable revenue streams despite regional demand fluctuations.

North American Demand Slump

At 12:19 p.m. EST, Reuters reported that Mosaic warned of an unusually steep drop in North American fertilizer demand during the fourth quarter. The company’s CEO noted that the decline is primarily driven by seasonal headwinds and a slowdown in agricultural production cycles. Mosaic’s response emphasizes its commitment to maintaining inventory levels and adjusting procurement strategies to mitigate the impact of lower consumption. The company also reiterated its view that the demand recovery is likely to accelerate in the first quarter of 2026 as planting cycles resume.

Market Context

The broader U.S. equity market exhibited a muted reaction throughout the trading day. Major indices such as the Dow Jones Industrial Average and the S&P 500 opened with slight gains but closed with modest declines, reflecting uncertainty surrounding the U.S. presidential transition and the impending long weekend. Mosaic’s decline mirrored this cautious sentiment, as investors weighed the company’s cash‑flow commentary against its robust market position and favorable valuation multiples.

Forward‑Looking Assessment

Mosaic’s market position as a leading producer and distributor of crop nutrients provides a solid foundation for long‑term growth. The company’s diversified product portfolio—spanning feed ingredients, crop nutrients, industrial products, concentrated phosphates, and potash—positions it well to capture incremental upside as global agricultural demand rebounds. However, the temporary North American demand slump underscores the need for disciplined cash‑flow management and inventory optimization.

Analysts anticipate that Mosaic will focus on:

- Optimizing Cash Flow – Enhancing working‑capital efficiency to safeguard liquidity amid lower demand.

- Inventory Management – Adjusting procurement to align with regional demand cycles without compromising market share.

- Cost Discipline – Continuing to leverage scale to manage input costs, particularly for phosphates and potash.

- Market Expansion – Exploring opportunities in emerging markets where fertilizer demand remains resilient.

With a market capitalization of approximately $8.36 billion and a P/E ratio below the sector average, Mosaic remains an attractive proposition for investors seeking exposure to the essential agribusiness segment. The company’s forthcoming full earnings report will provide a clearer picture of its financial health and strategic direction as the North American market begins to recover.