Schaeffler AG Positions Itself at the Nexus of Motion Technology, Robotics and Open‑Source Software

Schaeffler AG—an automotive and industrial supplier listed on the Frankfurt Stock Exchange—has announced a series of initiatives that position the company at the heart of the next wave of mobility and manufacturing innovation. While the stock’s price remains volatile, hovering near a 52‑week low of €3.154 and a high of €8.71, the company’s strategic moves hint at a future where software and robotics drive cost reductions and new revenue streams.

1. Motion Technology Showcased at CES 2026

On 4 January 2026, Schaeffler unveiled its latest motion technology portfolio at the Consumer Electronics Show (CES) in Las Vegas. The company highlighted advancements in engine, transmission and chassis systems, underscoring its commitment to delivering high‑performance components for electric and autonomous vehicles. The CES platform, traditionally dominated by consumer electronics, now serves as a proving ground for automotive suppliers eager to showcase integrated hardware–software solutions. Schaeffler’s participation signals an ambition to redefine how motion is engineered, combining mechanical precision with cutting‑edge electronics.

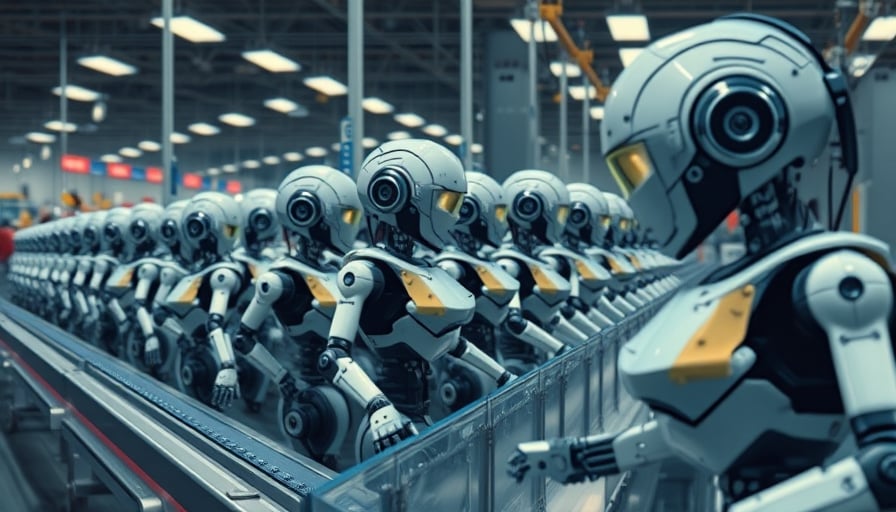

2. Robotics, Energy and Vehicle Tech: A New Chapter

Earlier that morning, the company released a statement detailing its expansion into robotics, energy and vehicle technology. By integrating robotics into manufacturing, Schaeffler seeks to streamline production lines, reduce labor costs and increase throughput. The energy component—particularly battery management systems—aligns with the industry’s shift toward electrification. Together, these initiatives form a comprehensive ecosystem that spans the entire value chain, from component design to end‑user deployment.

3. Open‑Source Software Collaboration

In a broader industry context, the German Association of the Automotive Industry (VDA) announced on 7 January 2026 that more than 30 suppliers—including Schaeffler—had joined an open‑source pact. The coalition aims to accelerate the development of next‑generation cars while cutting costs associated with proprietary software. The pact’s emphasis on non‑manufacturer‑specific solutions is particularly significant for Schaeffler, as it allows the company to contribute to and benefit from shared platforms that can be adapted across multiple OEMs. This collaborative approach is poised to reduce duplication of effort, shorten time‑to‑market and foster innovation through community‑driven improvements.

4. Market Sentiment and Capital Gains

Schaeffler’s actions occur against a backdrop of cautiously optimistic market sentiment. German equity indices, notably the SDAX, have posted modest gains in the first week of 2026, with the index rising by approximately 0.77 % on 7 January. Despite geopolitical uncertainties—most notably the escalation in Venezuela—investors continue to allocate capital toward automotive and industrial players that demonstrate forward‑looking capabilities. Schaeffler’s market capitalization of €8.15 billion reflects a valuation that balances its strong manufacturing heritage against a forward‑looking revenue model.

5. Challenges Ahead

Despite these positive developments, Schaeffler faces several headwinds. The negative price‑earnings ratio of –5.91 indicates that the market currently discounts the company’s earnings potential, perhaps reflecting concerns over declining margins in the automotive sector or the need for significant R&D investment. Moreover, the transition to open‑source software, while promising, requires careful management of intellectual property and revenue sharing models. Failure to navigate these complexities could erode the competitive advantage that the company seeks to build.

6. Conclusion

Schaeffler AG is unmistakably steering toward a future where motion, robotics and software converge. By leveraging the high‑profile platform of CES 2026, expanding into robotics and energy, and joining a large‑scale open‑source initiative, the company demonstrates both ambition and strategic alignment with industry trends. Investors will be watching closely as Schaeffler translates these initiatives into tangible revenue streams and market share gains, particularly as the automotive industry accelerates toward electrification and autonomous driving.