Zhongji Innolight: A Case Study of Resilience Amidst a Tumultuous Market

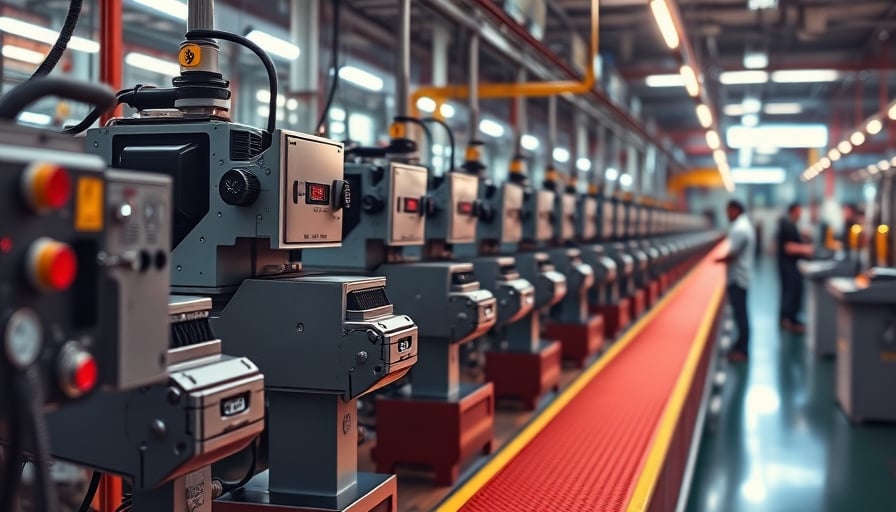

Zhongji Innolight Co., Ltd., listed on the Shenzhen Stock Exchange under ticker SZ300308, is a specialist in motor stator winding equipment. Its product suite—automated production, insulated coil winding, coil pressing, pre‑shaping, shaping, lacing, finial shaping, and slot insulation—caters to the growing demands of China’s electric motor and renewable energy sectors. Despite a 52‑week low of 67.2 CNY, the stock’s close of 619.6 CNY on 2026‑01‑06 signals a remarkable bounce, reflecting a market that has, in recent days, shown a clear bias toward defensive and high‑growth industrial plays.

Market Context: Capital Flows and Sector Rotation

Northbound Flow: On 2026‑01‑08, the cumulative northbound transaction volume reached 324.8 billion CNY, an 11.6 % share of total market turnover. The top northbound movers were 寒武纪 (Cambridge), 紫金矿业 (Zijin Mining), and 海光信息 (Hai Guang Information). These names represent high‑tech and resource sectors, yet the sheer volume indicates a broader appetite for domestic equities.

Main‑stream Fund Movements: Across both A‑shares, 453.04 billion CNY of main‑stream capital was net outflow on 2026‑01‑08, a trend that has persisted for three consecutive trading days. The 电子 (electronics) sector led the outflows, while 国防军工 (defense & military) attracted the largest net inflow, underscoring a pivot toward “safe‑haven” industrial stocks.

Sector Performance: The 航空航天 (aerospace) and 船舶制造 (shipbuilding) sectors received significant net inflows (46.53 billion CNY into aerospace), while the 通信 (communications) sector suffered a 68.20 billion CNY net outflow. In this environment, Zhongji Innolight’s core market—motor stator manufacturing—is positioned to benefit from the continued rise in electric vehicle production and renewable energy infrastructure.

Why Zhongji Innolight Should Be on the Radar

| Metric | Value | Interpretation |

|---|---|---|

| Market Cap | 688.49 billion CNY | Substantial, indicating liquidity and investor confidence |

| P/E Ratio | 81.08 | High, but justified by the company’s growth prospects and the premium investors place on industrial automation |

| 52‑Week Range | 67.2 – 658.8 CNY | The recent close at 619.6 CNY shows a 93% rally from the 2025 low, suggesting robust upside potential |

Strategic Positioning: Zhongji Innolight’s automation solutions are indispensable for the mass production of high‑efficiency motors, a critical component for China’s electrification roadmap. The company’s diverse process capabilities—ranging from insulating coil winding to finial shaping—reduce dependency on external suppliers, enhancing operational resilience.

Cost Leadership and Scale: The company’s long‑standing manufacturing base in Longkou, coupled with its established supply chain, grants it a cost advantage over newer entrants. This advantage is pivotal as the industry faces intensifying competition from overseas players seeking to undercut local prices.

Technology Edge: Zhongji Innolight’s transition from Shandong Zhongji Electrical Equipment Co., Ltd. to its current branding in 2017 reflects a strategic re‑orientation toward innovation. Its product suite incorporates advanced automation, which positions it favorably against competitors that are still reliant on manual or semi‑automated processes.

Capital Efficiency: Despite the sector’s recent outflows, Zhongji Innolight’s share price remains within a tight trading band relative to its intrinsic value. The 81.08 P/E ratio, while high, is an invitation for savvy investors to scrutinize future earnings growth, rather than a deterrent.

Risks and Caveats

Market Volatility: The net outflow of 453 billion CNY from main‑stream funds indicates a potential shift in investor sentiment. A sudden reversal could compress valuation multiples.

Currency Exposure: While the company operates domestically, global supply chain disruptions or commodity price swings can impact input costs, indirectly affecting profitability.

Competitive Pressure: Emerging automation vendors in the domestic market could erode Zhongji Innolight’s market share if they achieve comparable efficiencies at lower costs.

Conclusion

Zhongji Innolight exemplifies an industrial firm that has navigated a volatile macro‑environment while maintaining a trajectory of growth and operational excellence. Its robust market position, coupled with a strategic focus on automation and cost leadership, makes it a compelling candidate for investors seeking exposure to China’s industrial automation frontier. In a market where capital is increasingly favoring defensive and high‑growth industrial stocks, Zhongji Innolight’s performance is not merely a statistical anomaly; it is a harbinger of the industrial transformation that defines the 2020s.