Huizhou CEE Technology Inc: A Deep Dive into the Turbulent Waters of the Tech Sector

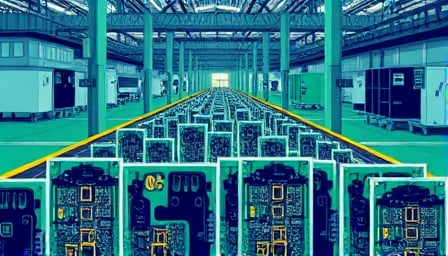

In the ever-evolving landscape of the Information Technology sector, Huizhou CEE Technology Inc stands as a testament to both the potential and the pitfalls that come with the territory. As a company specializing in the manufacturing of high-quality printed circuit boards, Huizhou CEE Technology has carved out a niche for itself in the competitive world of electronic equipment, instruments, and components. Yet, beneath the surface of its specialized product range, which includes rigid and flexible circuit boards, lies a story of financial turbulence that demands a closer examination.

A Financial Quagmire

At the heart of the matter is the company’s staggering Price Earnings (P/E) ratio of -259.199, a figure that sends shockwaves through the financial community. This negative P/E ratio is not just a number; it’s a glaring red flag that signals underlying issues within the company’s financial health. With a market capitalization of 7.48 billion CNH, one would expect a more stable financial footing. However, the reality is far from it. The company’s stock, traded on the Shenzhen Stock Exchange, has seen its fair share of volatility, with a 52-week high of 16.66 CNH and a low of 5.9 CNH. This volatility is a clear indicator of investor uncertainty and a lack of confidence in the company’s future prospects.

The IPO and Beyond

Huizhou CEE Technology’s journey began with its Initial Public Offering (IPO) on May 6, 2011. The IPO was a significant milestone, marking the company’s entry into the public market and setting the stage for its future endeavors. However, the years following the IPO have been anything but smooth sailing. The fluctuating stock prices and the negative P/E ratio are symptomatic of deeper issues that have plagued the company since its public debut.

Industry Position and Challenges

Despite these financial challenges, Huizhou CEE Technology has maintained its position in the industry, applying its products across various sectors such as consumer electronics, network communications, and computer peripherals. The company’s specialization in printed circuit boards is a critical component in the tech industry, underscoring its importance despite financial woes. However, the question remains: can Huizhou CEE Technology navigate the turbulent waters of the tech sector and emerge stronger?

Looking Ahead

As we stand in 2025, the future of Huizhou CEE Technology Inc hangs in the balance. The company’s ability to address its financial challenges, stabilize its stock prices, and regain investor confidence will be crucial in determining its trajectory. The tech sector is unforgiving, and only those who can adapt and overcome will survive.

In conclusion, Huizhou CEE Technology Inc’s story is a cautionary tale of the complexities and challenges inherent in the tech industry. While the company has demonstrated resilience and specialization in its field, its financial health remains a significant concern. As stakeholders and observers watch closely, the coming years will be critical in shaping the company’s destiny. Will Huizhou CEE Technology rise to the occasion, or will it succumb to the pressures of the market? Only time will tell.