IAMGOLD Corp: Market Dynamics and Strategic Outlook

IAMGOLD Corp, a mid‑tier gold miner listed on the Toronto Stock Exchange, closed at CAD 13.12 on 2 September 2025, comfortably within its 52‑week range that has spanned from CAD 6.07 to CAD 13.38. With a market capitalisation of approximately 5.25 billion CAD and a price‑earnings ratio of 6.80, the company remains attractively priced relative to peers in the precious‑metal sector.

Recent European Trading Activity

European equities finished the week on a modestly positive note, with the pan‑European Stoxx 600 gaining 0.6 % to 550.09 on Thursday, 4 September 2025. Paris, however, was the lone outlier, experiencing a decline that dampened broader gains. Against this backdrop, IAMGOLD’s own European listing—traded in euros—displayed a muted performance: the share closed at €8.17 (as of 12:26 UTC) and slipped 0.89 % to €7.99828 by 13:50 UTC. The euro‑denominated decline of roughly 19 cents reflects a broader lag in the gold‑mining subset of the market, which still trails the benchmark DAX‑Global Gold Miners index.

Despite the weaker euro‑price movement, the company’s Canadian share price remains relatively stable. The last recorded close of CAD 13.12 sits near the 52‑week high of CAD 13.38, suggesting that Canadian investors view the equity as a resilient play within the precious‑metal space, especially given gold’s perennial safe‑haven status.

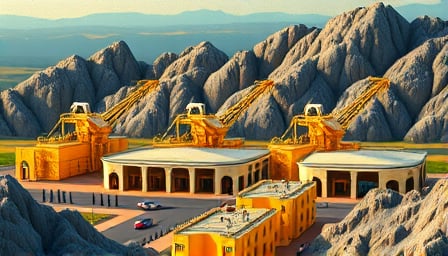

Operational Focus and Geographic Footprint

IAMGOLD’s portfolio is concentrated across West Africa, the Guiana Shield of South America, and Quebec, Canada. The company’s development pipeline in these regions is underpinned by robust exploration programs that have historically translated into incremental gold production and modest cash‑flow generation. The continued emphasis on West Africa—a region that has recently seen an uptick in regulatory clarity—positions IAMGOLD to capture value from emerging discoveries while mitigating geopolitical risk through diversification.

Forward‑Looking Perspective

Gold Price Sensitivity

The equity’s valuation remains tightly correlated with global gold prices. Should the price of gold rise above the current USD 1,850–USD 1,900 corridor, IAMGOLD is likely to benefit from an upside in cash‑flow and potentially a re‑valuation of its asset base. Conversely, prolonged downward pressure on gold could compress earnings and dampen share performance.Operational Efficiency

IAMGOLD’s mid‑tier status affords it a relatively low-cost base compared with larger peers, allowing for quicker responses to market shifts. The company’s ongoing efforts to streamline exploration costs and accelerate project timelines could further enhance its profitability profile, especially if production is accelerated in the Canadian portfolio.Capital Structure and Growth Funding

With a P/E of 6.80, the equity offers an attractive valuation relative to the sector, potentially supporting future equity or debt financing. The company’s recent 5‑year euro bond offering (as noted on 4 September 2025) indicates a willingness to diversify funding sources, which could provide a more stable capital base for exploration and development initiatives.Market Sentiment and Broader Economic Conditions

European markets are currently buoyed by a rebound in the Stoxx 600 and a slight easing of tariff concerns in the United States. IAMGOLD’s performance, however, has lagged due to the sector’s sensitivity to commodity cycles and investor appetite for higher‑yielding, lower‑risk assets. Sustained positive sentiment in the gold‑mining sector—particularly if supported by geopolitical stability in key mining regions—could lift IAMGOLD’s share price toward its 52‑week high.

Conclusion

IAMGOLD Corp’s share price, while experiencing recent volatility in its European listing, remains fundamentally sound within the broader precious‑metal landscape. The company’s strategic focus on diverse geographies, coupled with a conservative cost structure and a solid valuation profile, positions it well to capitalize on any upward movement in gold prices. Investors monitoring IAMGOLD should keep a close eye on commodity trends, geopolitical developments in West Africa, and the company’s execution of its development pipeline, as these factors will dictate the equity’s short‑ to medium‑term trajectory.