Financial Overview and Recent Developments – IDACORP, Inc.

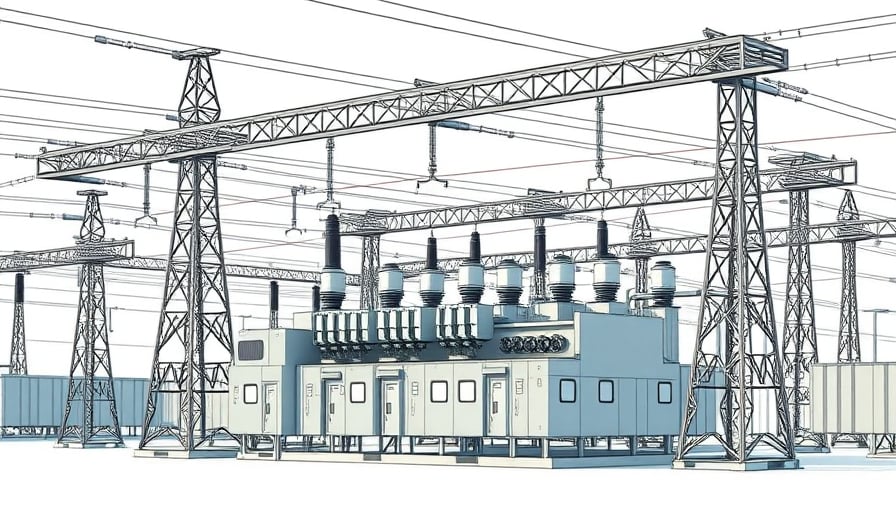

IDACORP, Inc. (NYSE: IDAC), a holding company in the electric utilities sector, operates across southern Idaho, eastern Oregon, northern Nevada, and Wyoming. The company’s core activities include generation, purchase, transmission, distribution, and sale of electricity. In addition, IDACORP manages affordable housing projects and other real‑estate investments.

Current Market Metrics (as of 2025‑10‑19)

| Metric | Value |

|---|---|

| Close Price | USD 137.70 |

| 52‑Week High | USD 138.03 |

| 52‑Week Low | USD 100.10 |

| Market Capitalisation | USD 7.34 billion |

| P/E Ratio | 23.9 |

The share price is near its recent 52‑week high, indicating a strong upward momentum. The price‑earnings ratio suggests investors are valuing the company at roughly 24 times earnings, which is within the typical range for regulated utilities.

Operational Highlights

- Service Area: The company’s electric utilities operations serve a combined population of several million residents across four states.

- Diversification: In addition to core electric utilities, IDACORP’s portfolio includes affordable housing and other real‑estate ventures, providing a diversified revenue stream.

- Regulatory Environment: As a regulated utility, the company operates under state utility commissions that influence tariff setting and capital investment approvals.

Recent News Activity

As of the latest data, there are no company‑specific press releases or regulatory filings for IDACORP, Inc. The news items available in the input relate to other organizations (Michael Baker International, MIC Electronics Limited, and unrelated entities) and do not pertain to IDACORP. Consequently, no new corporate actions, financial results, or strategic announcements are reported for the company in the current period.

Conclusion

IDACORP, Inc. maintains a solid market position in the regulated electric utilities sector, with a share price near its 52‑week peak and a diversified asset base that includes both utility and real‑estate holdings. While no recent company‑specific news has been issued, investors should monitor the company’s quarterly earnings releases and regulatory filings for updates on performance, capital projects, and policy changes that could influence valuation and dividend prospects.