Ingenic Semiconductor Co Ltd: Navigating the Tech Landscape

In the bustling world of semiconductors, Ingenic Semiconductor Co Ltd, a fabless technology company based in Beijing, continues to make waves. As of August 20, 2025, the company’s shares closed at 73.13 CNY on the Shenzhen Stock Exchange, with a market capitalization of 35,288,200,358 CNY. Despite a 52-week high of 95.67 CNY in March 2025, the company has faced challenges, reflected in its recent stock performance.

Technological Focus and Market Applications

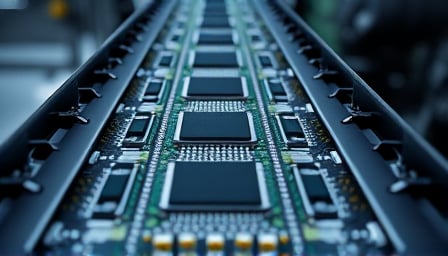

Ingenic Semiconductor specializes in embedded CPU products for mobile and consumer system-on-chip applications. Their solutions cater to the wearables and consumer devices markets, including smart IoT, smart videos, and smart wearables. These products find applications in biometrics, e-education, portable media players, e-readers, and mobile Internet devices.

Recent investor inquiries have highlighted the company’s focus on consumer market products. For instance, the company’s AI vision technology is primarily applied in consumer markets, and its chips are used in various consumer electronics like cameras, printers, and barcode scanners. However, the company has clarified that its products are not yet applied in VR, AR, or humanoid robots.

Innovations and Future Directions

Ingenic Semiconductor’s commitment to innovation is evident in its ongoing product developments. The company has introduced the T31, T40, and T41 models, with the T41 incorporating the Tizinao 3.1 technology. Looking ahead, the T33 model promises a significant technological upgrade and cost optimization, aiming to surpass the T31 in performance.

The company’s microprocessor chips, primarily from the X series, continue to be a focal point of their product lineup. Additionally, Ingenic’s subsidiary, Lumissil, has made strides with the GreenPHY CG531 chip, designed for electric vehicle charging systems and applicable to charging stations.

Strategic Partnerships and Business Operations

Ingenic Semiconductor maintains a strategic partnership with Huari Technology, leasing part of its property to the company. This relationship is strictly limited to property leasing, with no other business dealings reported.

Conclusion

As Ingenic Semiconductor Co Ltd navigates the competitive semiconductor landscape, its focus on consumer electronics and strategic innovations positions it well for future growth. With a robust product pipeline and a clear market strategy, the company continues to be a key player in the semiconductor industry.