Ingersoll Rand Inc.: A Financial Overview and Upcoming Earnings Report

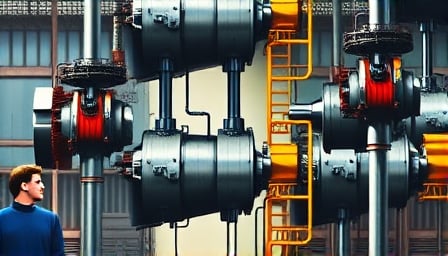

Ingersoll Rand Inc., a prominent player in the industrials sector, is set to release its quarterly earnings report on July 31, 2025. The company, known for its expertise in manufacturing flow control equipment, including vacuum systems, bottle blowers, pumps, and air and gas compressors, is a key supplier to a global customer base. As of July 29, 2025, Ingersoll Rand’s stock closed at $85.76 on the New York Stock Exchange, reflecting a market capitalization of $35.06 billion.

Analysts are keenly anticipating the earnings per share (EPS) for the quarter ending June 30, 2025. With 15 analysts providing estimates, the average expected EPS stands at $0.797. This figure is a critical indicator of the company’s financial health and operational efficiency, especially when compared to the previous year’s performance.

Ingersoll Rand’s financial metrics reveal a price-to-earnings (P/E) ratio of 41.952, suggesting investor expectations of future growth. However, the stock has experienced volatility, with a 52-week high of $106.03 on November 24, 2024, and a low of $65.61 on April 7, 2025. This range highlights the market’s fluctuating confidence in the company’s prospects amidst broader economic conditions.

As Ingersoll Rand prepares to unveil its latest financial results, stakeholders are closely monitoring the company’s strategic initiatives and market positioning. The upcoming earnings report will provide insights into the company’s ability to navigate industry challenges and capitalize on growth opportunities.

In the broader market context, other companies are also making headlines. American Vanguard Corporation has reported a significant improvement in its quarterly adjusted EBITDA, rising to $11 million from $6 million in the same quarter last year. This performance underscores a strengthening gross profit margin, now at 31% compared to 29% previously.

Meanwhile, iSpecimen Inc. has announced a $1.75 million private placement, issuing 1,559,828 shares of common stock. This move is part of the company’s strategy to bolster its financial position and expand its operations in the biospecimen marketplace.

As the financial landscape continues to evolve, Ingersoll Rand’s upcoming earnings report will be a pivotal moment for investors and analysts alike, offering a glimpse into the company’s future trajectory and its role within the industrials sector.