Intrusion Inc. Faces Market Challenges Amid Nasdaq Listing

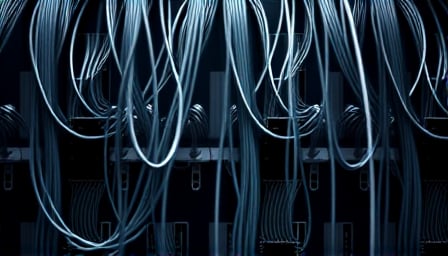

Intrusion Inc., a U.S.-based software company specializing in cybersecurity and real-time network monitoring, is navigating a challenging market landscape. Despite its pioneering role in protecting clients from zero-day and malware-free attacks, the company’s stock has experienced significant volatility. As of August 10, 2025, Intrusion’s shares closed at $1.81, a stark contrast to its 52-week high of $7.34 on December 29, 2024. This decline reflects broader market uncertainties and sector-specific pressures.

Market Position and Financial Overview

Intrusion Inc., listed on the Nasdaq since 1992, boasts a market capitalization of approximately $36.01 million. The company’s primary focus remains on safeguarding its clients, predominantly based in Texas, from contemporary cyber threats. Despite its specialized niche, Intrusion has faced challenges in maintaining investor confidence, as evidenced by its recent stock performance.

Strategic Focus and Future Outlook

Intrusion Inc. continues to emphasize its core competencies in cybersecurity, aiming to enhance its offerings in real-time network monitoring. The company’s strategic initiatives are geared towards expanding its client base beyond Texas, leveraging its expertise to address the growing demand for robust cybersecurity solutions. As cyber threats evolve, Intrusion’s commitment to innovation positions it to capitalize on emerging opportunities in the sector.

Conclusion

While Intrusion Inc. confronts current market headwinds, its long-standing presence and specialized focus on cybersecurity provide a foundation for potential recovery and growth. Investors and industry observers will closely monitor the company’s strategic moves as it seeks to navigate the complexities of the information technology landscape.