Manganese X Energy Corp (MEX), a prominent player in the mining sector, continues to navigate the complex landscape of metals and mining with a focus on lithium, metals, and copper exploration. Operating primarily in Canada, the company is listed on the TSX Venture Exchange and maintains a market capitalization of CAD 27,960,000. Despite the challenges reflected in its financial metrics, MEX remains committed to advancing its strategic initiatives.

As of December 28, 2025, MEX’s share price closed at CAD 0.14, within a 52-week range of CAD 0.05 to CAD 0.18. The peak price was recorded on November 2, 2025. The company’s financial indicators reveal a challenging earnings landscape, with a price-to-earnings ratio of -14.44, underscoring the absence of profitability in the current period. However, the price-to-book ratio of 11.2193 suggests a modest valuation relative to its book value, indicating potential for future growth.

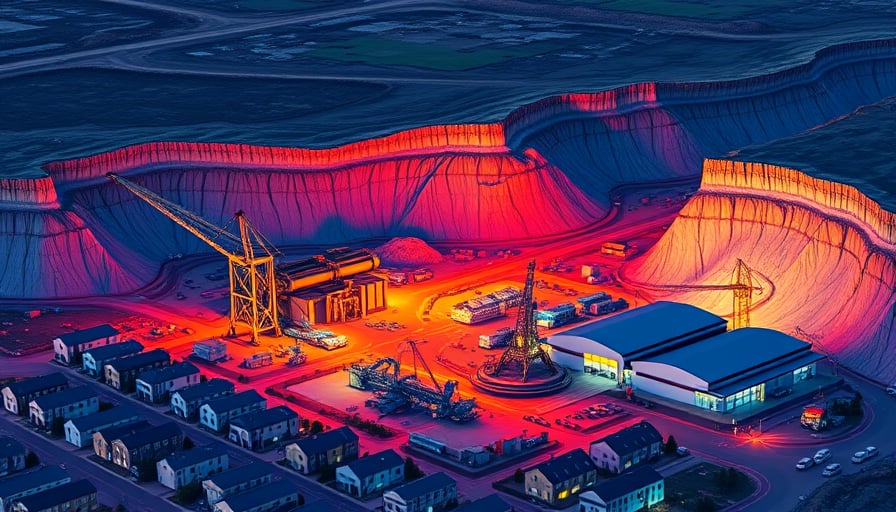

A significant development for MEX is the ongoing Battery Hill prefeasibility study, initiated in collaboration with ABH Engineering and GEMTEC Consulting. This study, first reported on December 3, 2025, underscores MEX’s strategic focus on lithium exploration, a critical component in the burgeoning battery market. The prefeasibility study aims to assess the viability of the Battery Hill project, potentially positioning MEX as a key player in the lithium supply chain.

Despite the absence of new corporate developments since the last transmission, MEX’s strategic initiatives and partnerships highlight its commitment to growth and innovation in the metals and mining sector. The company’s focus on lithium, metals, and copper exploration aligns with global trends towards sustainable energy solutions and technological advancements.

In summary, while Manganese X Energy Corp faces current financial challenges, its strategic projects and market positioning in the lithium sector present opportunities for future growth. Stakeholders and investors will closely monitor the outcomes of the Battery Hill prefeasibility study, which could significantly impact the company’s trajectory in the competitive landscape of metals and mining.