Iridium Communications Inc. Faces Market Challenges Amid Earnings Disappointment

Iridium Communications Inc., a U.S.-based company operating in the Communication Services sector, recently experienced a significant market downturn. On July 26, 2025, the company’s stock price plummeted by 22% following a disappointing earnings report and outlook. This sharp decline has brought Iridium’s stock to a low not seen since April 2025, when it hit $19.91. As of July 24, 2025, the close price stood at $25.7, with a 52-week high of $35.85 recorded on October 16, 2024. The company’s market capitalization is currently valued at $2.73 billion, and it trades on the Nasdaq under the ticker IRDM.

Despite the recent downturn, industry analysts suggest that the broader Satellite and Communication sector may still hold potential. According to a report from Zacks.com on July 28, 2025, macroeconomic uncertainties persist, but the growing demand for global connectivity could benefit industry participants like Iridium Communications, GSAT, and GILT. This perspective highlights the ongoing relevance of satellite communication services in an increasingly connected world.

In a notable development, Cathie Wood, the renowned hedge fund manager, made strategic moves involving Iridium Communications. On July 25, 2025, Wood’s ARK Invest sold off $16.46 million worth of Crispr Therapeutics (CRSP) and $2.15 million of Kratos Defense (KTOS) stock. Concurrently, ARK funds acquired 69,969 shares of Iridium Communications, valued at approximately $1.8 million, alongside investments in Absci Corp. (ABSI) and Veracyte (VCYT). This move indicates a strategic pivot towards companies with potential in satellite communication and biotechnology sectors.

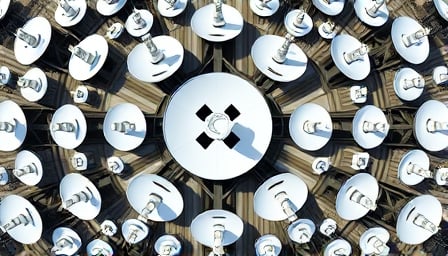

Iridium Communications continues to operate in the diversified telecommunication services industry, leveraging its satellite network in low-earth orbit to provide global voice and data communication services. These services cater to a wide range of clients, including governments, businesses, NGOs, and consumers. Despite the recent market challenges, the company’s strategic positioning in the satellite communication sector may offer long-term growth opportunities as global connectivity needs expand.

In summary, while Iridium Communications faces immediate market pressures due to its recent earnings report, the broader industry outlook remains cautiously optimistic. Investors and analysts will likely continue to monitor the company’s performance and strategic initiatives closely as it navigates the evolving telecommunications landscape.