Jack in the Box Inc., a prominent player in the Consumer Discretionary sector, has recently made headlines with a strategic move to reintroduce the Hot Mess Burger as a limited-time throwback classic. This decision is a calculated effort to tap into the nostalgia of its customer base, aiming to boost sales and customer engagement. The Hot Mess Burger, known for its unique combination of ingredients, has been a fan favorite in the past, and its return is expected to generate significant buzz and drive traffic to Jack in the Box locations nationwide.

However, the company is not without its challenges. This week, Jack in the Box found itself embroiled in a shareholder dispute that has drawn considerable attention. Biglari Capital, a notable shareholder, has called for a vote against the company’s chairman, signaling a significant governance issue. In response, Jack in the Box has taken a firm stance, urging its shareholders to support the full board of directors. This conflict underscores the complexities of corporate governance and the pressures faced by companies in maintaining shareholder confidence.

Amid these internal challenges, the broader economic landscape presents both opportunities and risks for Jack in the Box. Analysts project that the U.S. economy will continue to experience steady growth in 2026, bolstered by recent tax cuts and policy changes. While these factors are expected to have a modest impact on consumer spending, they also contribute to a cautious outlook for the consumer discretionary sector. Companies like Jack in the Box must navigate these evolving market conditions, balancing promotional initiatives with the need to address governance issues.

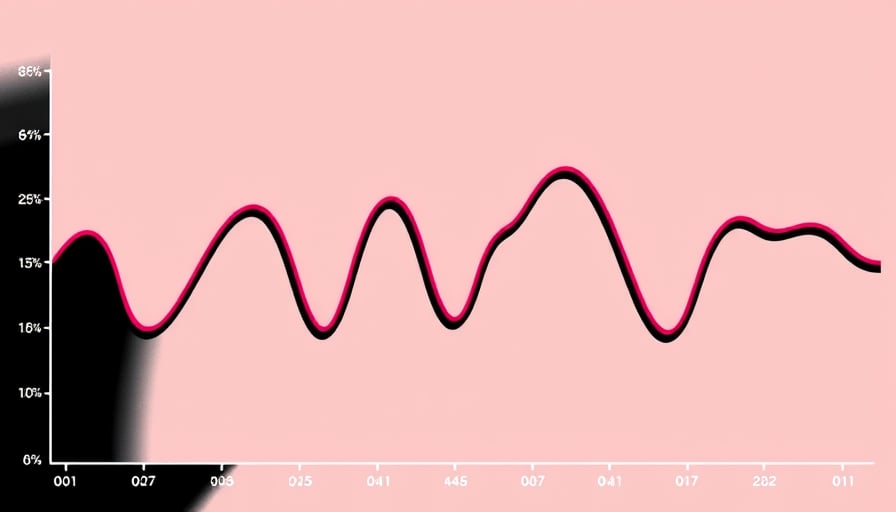

Jack in the Box’s recent performance metrics reflect the volatility and challenges within the sector. The company’s stock, listed on the Nasdaq, closed at $20.73 on February 12, 2026. This price point is significantly lower than the 52-week high of $41.09, reached on February 25, 2025, and higher than the 52-week low of $13.99, recorded on November 18, 2025. With a market capitalization of $387.38 million, Jack in the Box must strategically manage its resources to enhance shareholder value and sustain growth.

In conclusion, Jack in the Box Inc. stands at a critical juncture, facing both promotional opportunities and governance challenges. The reintroduction of the Hot Mess Burger is a bold move to capture consumer interest, while the shareholder dispute highlights the need for robust corporate governance. As the company navigates these dynamics, its ability to adapt to market conditions and maintain shareholder trust will be crucial in determining its future trajectory in the competitive landscape of the Consumer Discretionary sector.