Jiangsu Leadmicro Nano Technology Co Ltd: Recent Market Performance and Business Development

Market Context

On September 8, 2025, the Shanghai Stock Exchange’s semiconductor sector experienced a late‑afternoon rebound. Jiangsu Leadmicro Nano Technology Co Ltd (ticker 300033) surged more than 18 % during that session, outperforming peers such as Zhongwei Co., Xindong Technology and Tianyu Advanced. The rally reflected broader optimism about the semiconductor market, which has been gaining traction after a period of subdued activity.

Company‑Led Innovation

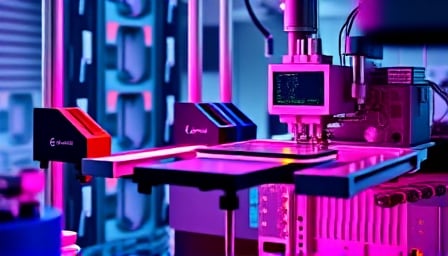

The company’s chief technology officer and vice chairman, Li Weiming, highlighted the strategic importance of thin‑film deposition technology in a keynote speech at the 13th China Semiconductor Equipment & Core Components and Materials Exhibition (CSEAC 2025). Li emphasized the growth of transistor counts toward a “two‑quadrillion” milestone and the consequent demand for advanced deposition equipment. He noted that Leadmicro’s atomic‑layer deposition (ALD) multi‑step exposure system can push chip process nodes beyond current lithography limits, thereby supporting domestic chip development. Under his leadership, Leadmicro has shipped nearly 500 semiconductor devices in less than five years and has surpassed foreign competitors in high‑dielectric‑constant material performance.

Financial Activity

On September 5, the company attracted significant financing interest, with a net financing purchase of 45.40 million CNY, accounting for 26.66 % of that day’s total inflow. The outstanding financing balance rose to 3.77 billion CNY, an increase of 2.64 % from the previous day, exceeding the 90th percentile historical level. Meanwhile, short‑selling activity remained modest, with a net short‑sale balance of only 48.37 thousand shares, below the 10th percentile historical range.

Revenue Mix Shift

Leadmicro has historically focused on photovoltaic (PV) equipment, with ALD and CVD technologies being pivotal in high‑efficiency solar cell production. However, a recent investor inquiry revealed a notable shift in revenue composition. The semiconductor segment’s contribution to total revenue rose from 7.27 % in 2023 to 18.45 % in the first half of 2025, underscoring the company’s accelerated expansion in the semiconductor industry.

Current Market Position

As of July 31, 2025, Leadmicro’s closing share price stood at 34.5 CNY, with a market capitalization of approximately 17.95 billion CNY. The 52‑week high (33.88 CNY) and low (18.35 CNY) illustrate a broad trading range, while a price‑earnings ratio of 57.75 reflects investor expectations of future growth.

Conclusion

Leadmicro Nano Technology’s recent stock surge, driven by positive sentiment in the semiconductor sector, aligns with its strategic emphasis on advanced thin‑film deposition technology. The company’s rapid growth in semiconductor device shipments, increasing revenue share from semiconductor equipment, and robust financing activity position it as a significant player in China’s evolving semiconductor ecosystem.