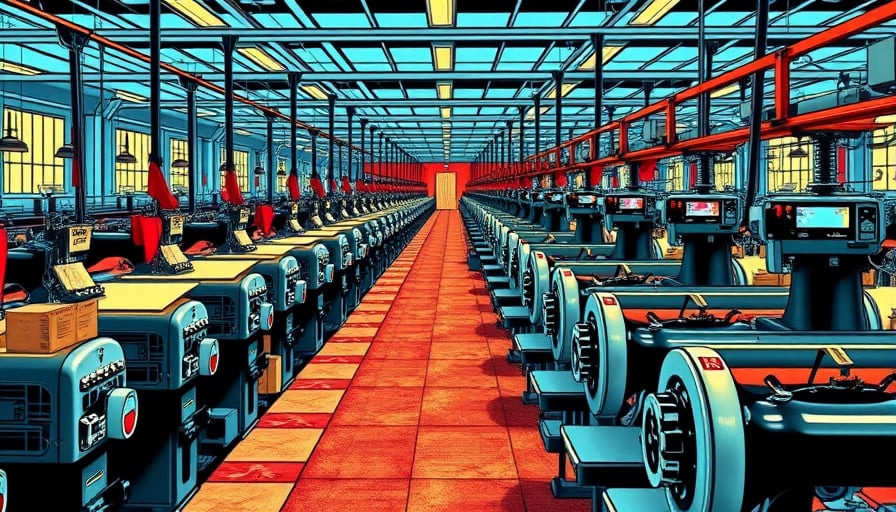

The Jiangsu Soho High Hope Group Corp, a prominent entity within the Consumer Discretionary sector, has been a subject of considerable scrutiny and interest in recent times. As a company primarily engaged in the distribution of fabrics and textiles, its operations extend beyond mere trade services to encompass real estate, investment, manufacturing, transit, and logistics. Based in Nanjing, this domestic trade service provider has carved a niche for itself in both the export and import markets, as well as in domestic sales, thereby positioning itself as a versatile player in the industry.

With its listing on the Shanghai Stock Exchange, Jiangsu Soho High Hope Group Corp has demonstrated a fluctuating financial trajectory over the past year. As of November 27, 2025, the company’s close price stood at 3.08 CNY, a figure that, while modest, reflects a broader narrative of volatility. The company’s 52-week high, recorded on December 12, 2024, at 3.37 CNY, juxtaposed against its 52-week low of 2.05 CNY on April 8, 2025, underscores a period of significant financial turbulence. This volatility is further accentuated by a market capitalization of 6.91 billion CNY, a testament to the company’s substantial presence in the market despite the challenges it faces.

A critical examination of Jiangsu Soho High Hope Group Corp’s financial health reveals a Price Earnings (P/E) ratio of 60.51, a figure that raises questions about the company’s valuation and the market’s perception of its future growth prospects. Such a high P/E ratio suggests that investors are expecting high earnings growth in the future compared to the current earnings. However, this optimism must be tempered with caution, as the company’s diverse ventures into real estate, investment, and logistics, while indicative of strategic diversification, also expose it to a myriad of risks inherent in these sectors.

The company’s foundation, dating back to its Initial Public Offering (IPO) on June 15, 2004, marks over two decades of operation in a rapidly evolving market landscape. This longevity, coupled with its strategic diversification, positions Jiangsu Soho High Hope Group Corp as a formidable entity within the Consumer Discretionary sector. However, the path forward is fraught with challenges. The company must navigate the complexities of the global trade environment, manage the risks associated with its diversified ventures, and address the concerns raised by its financial metrics.

In conclusion, Jiangsu Soho High Hope Group Corp stands at a critical juncture. Its ability to leverage its diversified portfolio, manage financial volatility, and capitalize on future growth opportunities will be pivotal in determining its trajectory in the coming years. As stakeholders and observers closely monitor its progress, the company’s strategic decisions will undoubtedly have far-reaching implications for its future and the broader market landscape.