Kirkland’s Inc. Faces Challenges Amid Market Fluctuations

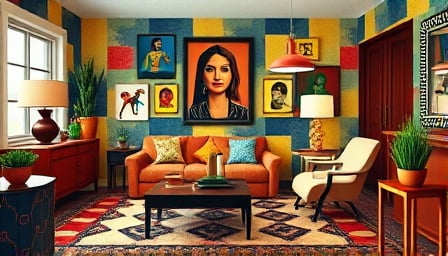

In the ever-evolving landscape of the consumer discretionary sector, Kirkland’s Inc., a Brentwood-based retailer specializing in home decor and gifts, finds itself navigating through turbulent market conditions. Known for its diverse range of products, including framed art, candles, lamps, picture frames, rugs, garden accessories, artificial plants, and holiday merchandise, the company has been a staple for those looking to enhance their living spaces with unique and thoughtful items.

As of July 24, 2025, Kirkland’s Inc. shares closed at $1.49 on the Nasdaq, reflecting a significant downturn from its 52-week high of $2.5, recorded on October 20, 2024. This decline in share price is indicative of the challenges faced by the company in a competitive market. The 52-week low, observed on June 22, 2025, at $1.05, underscores the volatility Kirkland’s has experienced over the past year.

With a market capitalization of $35,260,000, Kirkland’s Inc. operates within the specialty retail industry, a sector that demands constant innovation and adaptation to consumer trends. The company’s price-to-earnings ratio stands at -0.963687, a figure that highlights the financial hurdles it currently faces. This negative ratio suggests that the company is not generating profits, a situation that could be attributed to various factors, including increased competition, shifts in consumer spending habits, or operational challenges.

Despite these challenges, Kirkland’s Inc. remains committed to its mission of providing consumers with a wide array of home decor and gift options. The company’s strategy moving forward may involve a reevaluation of its product offerings, marketing strategies, and operational efficiencies to better align with current market demands and consumer preferences.

As Kirkland’s Inc. navigates through these uncertain times, the company’s ability to adapt and innovate will be crucial to its recovery and future success. Stakeholders and consumers alike will be watching closely to see how the company evolves in response to the dynamic retail landscape.

In conclusion, while Kirkland’s Inc. faces significant challenges, its established presence in the specialty retail industry and commitment to offering diverse and unique products provide a foundation upon which to build a strategy for recovery and growth. The coming months will be critical for the company as it seeks to regain its footing and chart a course towards profitability and sustainability in the consumer discretionary sector.