Knorr-Bremse AG: Navigating Market Turbulence Amidst Global Economic Shifts

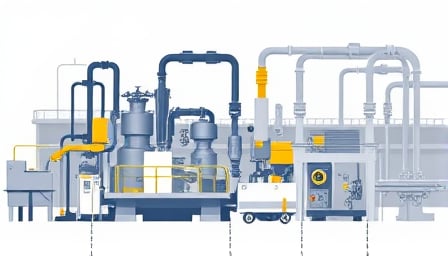

In the ever-volatile world of financial markets, Knorr-Bremse AG, a titan in the industrial machinery sector, finds itself at a critical juncture. As of May 5, 2025, the company’s stock is trading at 88 EUR, a noticeable dip from its 52-week high of 96.4 EUR on March 17, 2025. With a market capitalization of 14.06 billion EUR and a price-to-earnings ratio of 31.58, the stakes are high for this Munich-based powerhouse known for its braking systems for rail and commercial vehicles, among other products.

Market Dynamics and Analyst Sentiments

The financial landscape in Europe has been anything but stable. Recent news highlights a wave of sell recommendations from experts, urging investors to offload shares in favor of safer assets. This sentiment is echoed in the broader market trends, where European stocks have been buoyed by optimistic data and hopes for resolution in trade disputes. The DAX, Germany’s premier stock index, has been flirting with all-time highs, closing at 23,087 points, a 2.6% increase, fueled by positive US employment data and potential progress in trade tensions.

Knorr-Bremse’s Position in the Market

Despite the broader market’s resilience, Knorr-Bremse’s stock has not been immune to the pressures. The company’s performance is a microcosm of the challenges facing the industrial sector, where geopolitical tensions and economic uncertainties loom large. With a significant presence in both rail and commercial vehicle markets, Knorr-Bremse’s fortunes are closely tied to global economic health and trade dynamics.

Looking Ahead

As the market navigates through these turbulent times, Knorr-Bremse’s strategic decisions will be under scrutiny. Investors and analysts alike will be watching closely to see how the company adapts to the shifting economic landscape. Will Knorr-Bremse leverage its robust product portfolio and global reach to weather the storm, or will it succumb to the pressures of a challenging market environment?

In conclusion, Knorr-Bremse AG stands at a crossroads, with its future performance hinging on both internal strategic maneuvers and external economic forces. As the company navigates these uncertain waters, its ability to adapt and innovate will be key to maintaining its position as a leader in the industrial machinery sector.