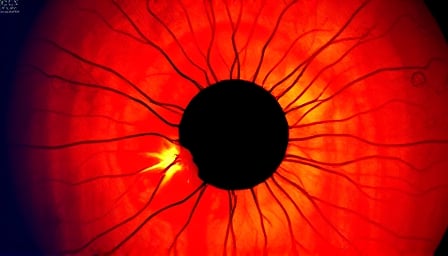

Kodiak Sciences Inc., a clinical-stage biopharmaceutical company, has been navigating the tumultuous waters of the biotechnology sector with a focus on developing novel therapeutics for chronic and high-prevalence retinal diseases. As a key player in the health care industry, Kodiak Sciences operates primarily within the United States, offering innovative solutions to a significant medical need. However, the company’s financial metrics and market performance raise critical questions about its current trajectory and future prospects.

As of September 3, 2025, Kodiak Sciences’ stock closed at $8.55, a stark contrast to its 52-week high of $11.6, recorded on December 8, 2024. This decline underscores the volatility and challenges faced by the company in a highly competitive and capital-intensive industry. The 52-week low of $1.92, observed on April 8, 2025, further highlights the financial instability and investor skepticism surrounding Kodiak Sciences’ ability to deliver on its promises.

With a market capitalization of $493.35 million, Kodiak Sciences is a relatively small player in the biotechnology sector. This valuation reflects not only the company’s current financial health but also the market’s perception of its potential to achieve commercial success. The negative price-to-earnings ratio of -2.242 is particularly telling, indicating that the company is not currently profitable and may continue to incur losses in the near term. This metric is a critical red flag for investors, suggesting that Kodiak Sciences’ revenue generation capabilities are insufficient to cover its expenses, let alone yield profits.

Kodiak Sciences’ journey since its Initial Public Offering (IPO) on October 4, 2018, has been marked by ambitious goals and significant challenges. The company’s focus on retinal diseases, while noble and necessary, requires substantial investment in research and development, clinical trials, and regulatory approvals. These processes are inherently risky and time-consuming, often stretching over several years before any potential product can reach the market.

The company’s listing on the Nasdaq stock exchange provides it with visibility and access to capital markets, yet it also subjects Kodiak Sciences to the scrutiny and expectations of public investors. The fluctuating stock price and negative financial metrics suggest that the company has yet to convince the market of its ability to translate its scientific endeavors into commercial success.

In conclusion, while Kodiak Sciences Inc. remains committed to its mission of developing groundbreaking therapeutics for retinal diseases, its financial performance and market valuation raise significant concerns. The company’s future hinges on its ability to navigate the complex landscape of biotechnology development, secure necessary funding, and ultimately deliver viable products to the market. Until then, investors and stakeholders must weigh the potential rewards against the inherent risks and uncertainties that characterize Kodiak Sciences’ current position.