Kontron AG’s Bold Shift to Europe: A Strategic Leap Beyond China

Kontron AG, the German‑based provider of embedded computing solutions, has announced a decisive relocation of its manufacturing base from China to Hungary. The move, announced by Hungarian Deputy Prime Minister Péter Szijjártó on January 29, 2026, will see the company invest approximately 2 billion HUF (roughly 5.5 million EUR) in a new facility in Pécs, creating 30 permanent jobs and securing an additional 300 positions within the surrounding supply chain.

The announcement comes at a time when the TecDAX index has been dominated by declining shares—SAP, Siemens Healthineers, and even the high‑tech stalwart TeamViewer have posted losses of between 6 % and 18 % during the month of January. Kontron’s decision to move production to Europe is therefore a stark counter‑example to the broader narrative of tech companies retreating from the continent.

Why Hungary?

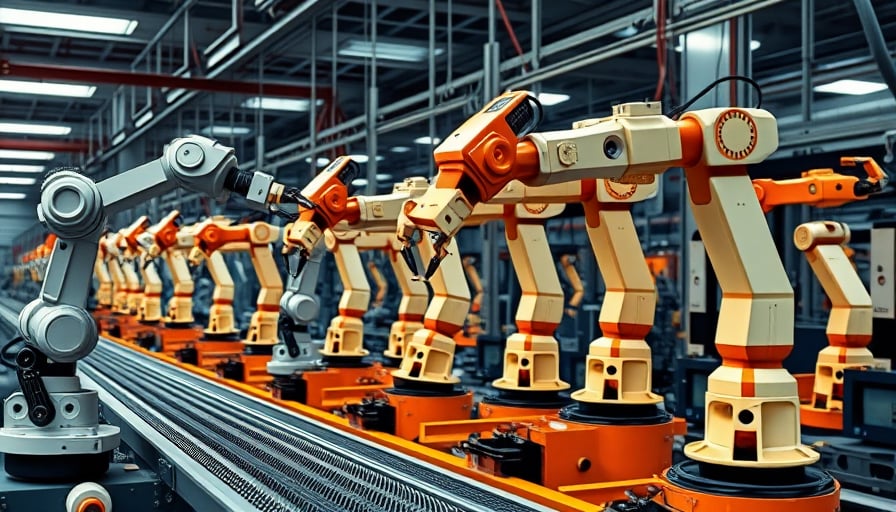

The Hungarian government is providing a 400 million HUF grant, underscoring a state‑backed commitment to high‑tech manufacturing. The new plant will focus on producing “complex electronic components, automated control solutions and high‑tech products” for the medical, aerospace and robotics sectors—areas where Kontron’s expertise in IoT and embedded systems is already well‑established. By relocating production, Kontron eliminates the risk of supply‑chain disruptions that have plagued the industry since the onset of the pandemic and the ensuing geopolitical tensions.

A Strategic Pivot

Kontron’s core business—embedded computer modules, boards, and systems—has long been tailored to clients worldwide. Yet the company’s share price of €23.44 on 29 January sits well below its 52‑week low of €18.38, reflecting a market that has been reluctant to reward its recent strategic initiatives. The 10.81 P/E ratio suggests investors are still skeptical about the company’s future earnings trajectory.

The relocation to Hungary signals a shift from a cost‑focused, China‑centric production model to a value‑centric, proximity‑based approach. This pivot is not merely about lower logistics costs; it is a deliberate statement that Kontron is positioning itself as a European manufacturer capable of delivering the stringent quality and compliance standards demanded by the medical and aerospace industries.

Implications for Stakeholders

For investors, the move represents a potential upside. By diversifying its manufacturing footprint, Kontron reduces exposure to Chinese regulatory risk and strengthens its appeal to European clients who increasingly demand local sourcing. The 400 million HUF grant is effectively a subsidy that improves the capital‑budget profile of the expansion, potentially leading to higher return on invested capital.

For employees, the establishment of a new plant in Hungary offers tangible career opportunities. The company’s commitment to 30 new permanent roles demonstrates a willingness to invest in human capital beyond the immediate profit‑maximisation imperative that has driven many firms to outsource production.

For the wider market, Kontron’s announcement may spur a re‑evaluation of the TecDAX composition. While the index has suffered a downturn in January—SAP, Siemens Healthineers, and TeamViewer all reporting significant declines—Kontron’s proactive strategy could serve as a catalyst for renewed confidence in technology firms that prioritize resilience over short‑term cost savings.

A Call to Action

Kontron AG’s move to Hungary is not just a relocation; it is a bold statement that the company is ready to confront the uncertainties of global supply chains head‑on. In a market that has seen a wave of declines across the TecDAX, Kontron’s decision to invest locally, secure government support, and target high‑growth sectors such as medical technology and robotics is a clear signal to investors: this company is not content to simply survive; it intends to lead.

Stakeholders must now watch closely. If Kontron can translate this strategic realignment into increased operational efficiency and stronger market positioning, it could reverse its current valuation lag and set a new benchmark for the industry. The time for cautious speculation is over; the time for decisive action—and for investors to heed it—is now.