Lithium Corp: A Rollercoaster Ride in the Metals & Mining Sector

In the volatile world of metals and mining, Lithium Corp stands as a testament to the unpredictable nature of the industry. Based in Reno, United States, this exploration company has been on a relentless quest for lithium in the Southwestern part of the country. However, recent financial figures paint a picture of a company caught in the throes of market instability.

As of August 12, 2025, Lithium Corp’s close price stood at a mere $0.036, a stark contrast to its 52-week high of $0.062 on April 23, 2025. This dramatic fluctuation underscores the precarious position of Lithium Corp within the sector. The company’s 52-week low, recorded at $0.023 on June 8, 2025, further highlights the volatility and the challenges faced by the company in maintaining a stable market presence.

With a market capitalization of $4,244,126 USD, Lithium Corp’s financial standing raises questions about its sustainability and growth prospects in the competitive metals and mining industry. The company’s listing on the Other-OTC stock exchange adds another layer of complexity, given the exchange’s reputation for housing smaller, less liquid companies.

The Quest for Lithium: A Double-Edged Sword

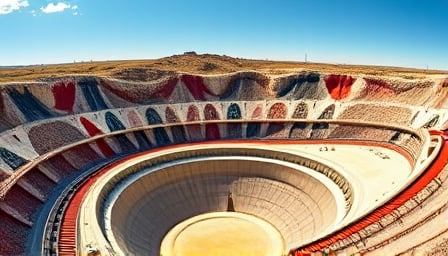

Lithium Corp’s specialization in lithium exploration is both its greatest strength and its most significant challenge. The global demand for lithium, driven by the electric vehicle (EV) boom and renewable energy storage solutions, positions Lithium Corp at the forefront of a critical industry. However, the company’s ability to capitalize on this demand is hampered by its financial instability and the inherent risks of exploration.

The Southwestern United States, where Lithium Corp focuses its exploration efforts, is a region rich in lithium deposits. Yet, the path from exploration to extraction and production is fraught with regulatory, environmental, and logistical hurdles. Lithium Corp’s journey in this landscape is emblematic of the broader challenges facing the metals and mining sector.

Looking Ahead: A Path Fraught with Uncertainty

As Lithium Corp navigates the tumultuous waters of the metals and mining industry, its future remains uncertain. The company’s financial metrics, coupled with the volatile nature of the lithium market, suggest a challenging road ahead. For Lithium Corp to stabilize and grow, it must not only overcome the immediate financial hurdles but also strategically position itself to capitalize on the burgeoning demand for lithium.

Investors and industry observers alike will be watching closely as Lithium Corp attempts to turn its exploration endeavors into profitable ventures. The company’s ability to adapt to the rapidly changing landscape of the metals and mining sector will be critical to its survival and success.

In conclusion, Lithium Corp’s story is a microcosm of the broader challenges and opportunities within the metals and mining industry. As the demand for lithium continues to soar, the company’s journey will be a litmus test for the sector’s ability to meet the world’s growing energy needs sustainably and profitably.