LogicMark Inc., a prominent player in the Information Technology sector, has recently been the subject of intense scrutiny due to its dramatic stock performance. As a health care software company based in Louisville, United States, LogicMark specializes in developing cutting-edge care technology and emergency systems, with a particular focus on biometric secure access control. Despite its innovative offerings and global customer base, the company’s financial trajectory has raised eyebrows among investors and analysts alike.

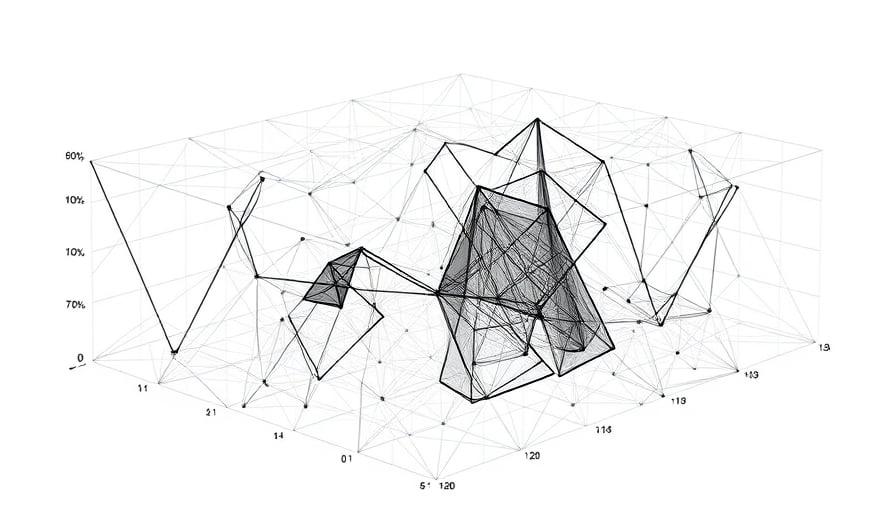

As of October 30, 2025, LogicMark’s stock closed at a mere $1.2, a stark contrast to its 52-week high of $5,250 recorded on November 11, 2024. This precipitous decline highlights a volatile market response, leaving the company’s future in a precarious position. The recent 52-week low of $1.13, observed on October 27, 2025, underscores the instability and investor apprehension surrounding the company’s financial health.

The company’s primary exchange, the OTC Bulletin Board, reflects its current market standing, which is a far cry from its Nasdaq trading days. This shift in trading venues often signals a loss of investor confidence and can be indicative of deeper underlying issues within the company. The drastic reduction in stock value raises critical questions about LogicMark’s strategic direction, operational efficiency, and market competitiveness.

Despite these financial challenges, LogicMark continues to serve a global clientele, leveraging its expertise in biometric secure access control to provide innovative solutions in the health care sector. However, the company’s ability to maintain its market position and regain investor trust remains uncertain. The stark disparity between its past and present stock performance suggests that LogicMark must address significant internal and external challenges to restore its former glory.

In conclusion, LogicMark Inc. stands at a critical juncture. The company’s innovative products and global reach are overshadowed by its financial volatility and declining stock value. As LogicMark navigates this turbulent period, it must implement strategic measures to stabilize its operations, reassure investors, and reclaim its position in the competitive landscape of health care software. The coming months will be pivotal in determining whether LogicMark can overcome these challenges and emerge stronger or if it will continue to struggle in the face of mounting adversity.