Longhorn Auto Co Ltd: A Rollercoaster Ride on the Shenzhen Stock Exchange

In the ever-volatile world of the automobile industry, Longhorn Auto Co Ltd stands as a testament to the unpredictable nature of market dynamics. Based in Shenzhen, Guangdong Province, this Chinese automobile manufacturer has been navigating through turbulent waters, as evidenced by its recent performance on the Shenzhen Stock Exchange.

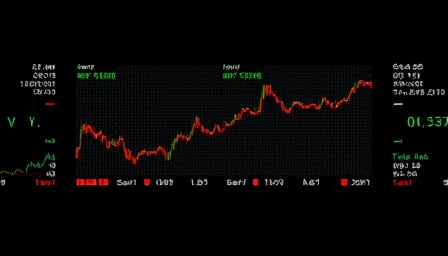

As of April 29, 2025, Longhorn Auto’s closing price was recorded at 60.55 CNY, a figure that starkly contrasts with its 52-week high of 81.1 CNY, achieved on February 13, 2025. This dramatic fluctuation underscores the volatility that investors face in the automotive sector, particularly in the Chinese market. The company’s 52-week low, a mere 43.55 CNY on September 17, 2024, further highlights the precarious nature of its stock performance.

Market Cap and Financial Health: A Closer Look

With a market capitalization of 5,225,999,929 CNY, Longhorn Auto Co Ltd holds a significant position in the industry. However, the company’s Price to Earnings (P/E) ratio of 51.7036 raises eyebrows. This high P/E ratio suggests that investors are paying a premium for the company’s earnings, a scenario that often indicates either high growth expectations or a potential overvaluation. In the context of Longhorn Auto, this could be a red flag for investors seeking stable returns.

The Shenzhen Stock Exchange: A Double-Edged Sword

Trading on the Shenzhen Stock Exchange, Longhorn Auto is subject to the whims of one of China’s most dynamic financial markets. While this provides the company with a platform to access capital and grow, it also exposes it to the rapid shifts in investor sentiment and regulatory changes that characterize the Chinese stock market. The recent volatility in Longhorn Auto’s stock price is a testament to the challenges and opportunities presented by this environment.

Conclusion: Navigating Uncertainty

Longhorn Auto Co Ltd’s journey through the peaks and valleys of the stock market is a microcosm of the broader challenges facing the automotive industry in China. With a high P/E ratio and significant market cap, the company is at a crossroads. Will it leverage its position to drive growth and innovation, or will it succumb to the pressures of market volatility and investor skepticism?

As Longhorn Auto continues to navigate these uncertain waters, investors and industry watchers alike will be keenly observing its next moves. The company’s ability to adapt and innovate in the face of these challenges will be crucial in determining its future trajectory in the competitive landscape of the Chinese automobile industry.