MAC Copper Ltd Announces Shareholder Approval for Acquisition by Harmony

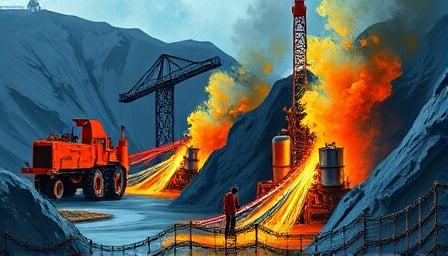

On August 29, 2025, MAC Copper Limited (NYSE:MTAL, ASX:MAC), a materials sector company based in Jersey with operations at the CSA copper mine in New South Wales, Australia, announced that its shareholders have voted in favor of a proposed acquisition by Harmony Gold (Australia) Pty Ltd. This acquisition is set to be executed through a Jersey law scheme of arrangement under Article 125 of the Companies (Jersey) Law 1991.

The scheme involves Harmony Gold Mining Company Limited, a wholly-owned subsidiary of Harmony Gold (Australia) Pty Ltd, acquiring 100% of the issued share capital of MAC Copper Limited. The decision was supported by a significant majority of MAC shareholders, with 98.43% of votes cast at the Court Meeting in favor of the scheme. Additionally, 87.50% of Scheme Shareholders present and voting at the Court Meeting supported the resolution.

The acquisition is subject to approval by the Jersey Court, and the directors of MAC have been authorized to implement the scheme and address related ancillary matters. The alteration of MAC’s Articles of Association has also been approved as part of this process.

Financial Context and Market Reaction

As of August 27, 2025, MAC Copper Limited’s close price was $12.14, with a 52-week high of $14.31 and a low of $7.69. The company’s market capitalization stands at $1 billion USD, and it has a price-to-earnings ratio of -12.27, indicating a challenging financial period.

In related news, Harmony Gold Mining Company Limited, the parent company of Harmony Gold (Australia) Pty Ltd, has experienced a drop in share prices due to rising operational costs. Despite record bullion prices boosting profits, Harmony anticipates a 9% to 16% increase in costs for the fiscal year starting July 1, 2025. This increase is attributed to inflationary pressures and updated mine plans. Harmony’s capital expenditure is expected to rise to nearly 13 billion rand ($734 million) from 11 billion rand in 2025, driven by projects to extend the lifespan of its flagship operations in South Africa and replace machinery in Papua New Guinea.

Conclusion

The acquisition of MAC Copper Limited by Harmony Gold represents a strategic move in the materials sector, particularly in the context of the green economy and copper mining. The approval by MAC shareholders marks a significant step forward in the transaction, pending final court approval. Meanwhile, Harmony Gold faces challenges related to rising costs, which could impact its financial performance in the near term.